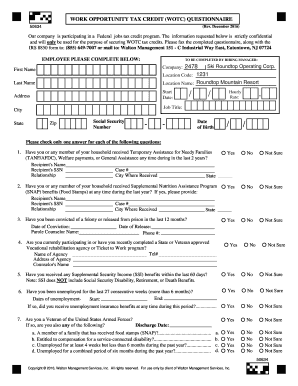

Work Opportunity Tax Credit Questionnaire Ssn

Enter the applicant’s name and social security number as they appear on the applicant’s social security card. A company hiring these seasonal workers receives a tax credit of $1,200 per worker.

Adp - Work Opportunity Tax Credit Wotc Avionte Bold

Employers may meet their business needs and claim a tax credit if they.

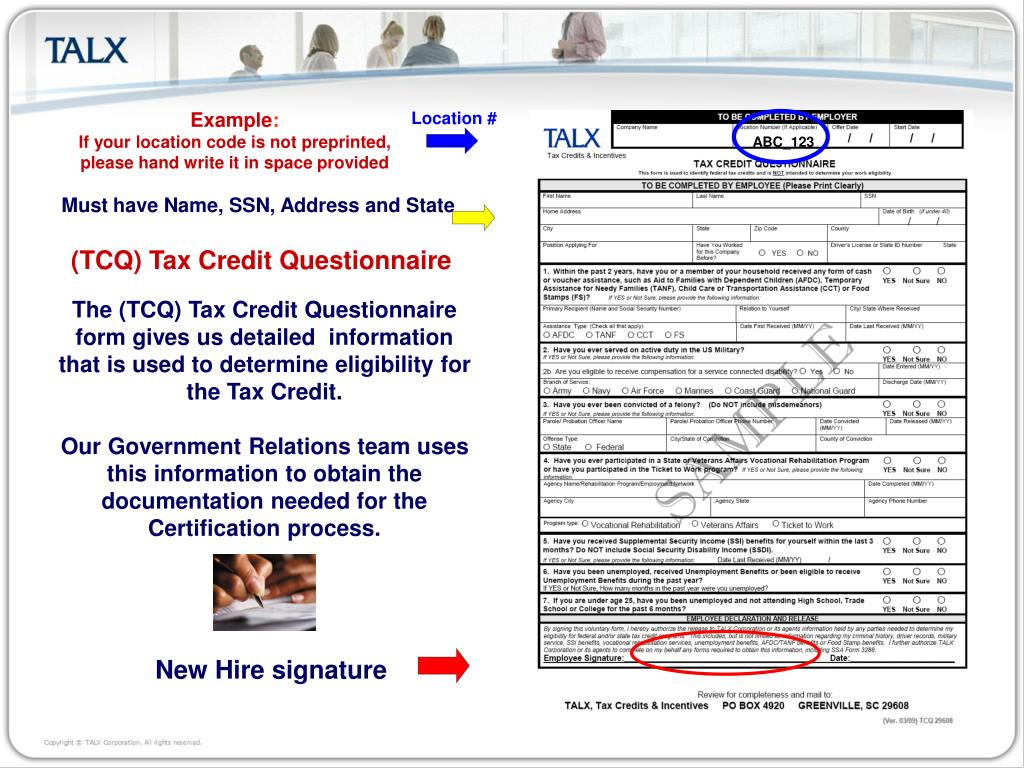

Work opportunity tax credit questionnaire ssn. Your name social security number a street address where you live city or town, state, and zip code county telephone number California’s electronic wotc (ewotc) application process is a paperless alternative to the original wotc application process which requires employers to mail the irs form 8850 and department of labor (dol) individual characteristics form (icf) 9061 and any supporting documentation to their state workforce agency. These surveys are for hr purposes and also to determine if the company is eligible for a tax credit/deduction.

Fill in the lines below and check any boxes that apply. A work opportunity tax credit questionnaire helps to find out whether a company is following the work opportunity tax credit program as directed by the federal government. If you are in one of the “target groups” listed below, an employer who hires you could receive a federal tax credit of up to $9,600.

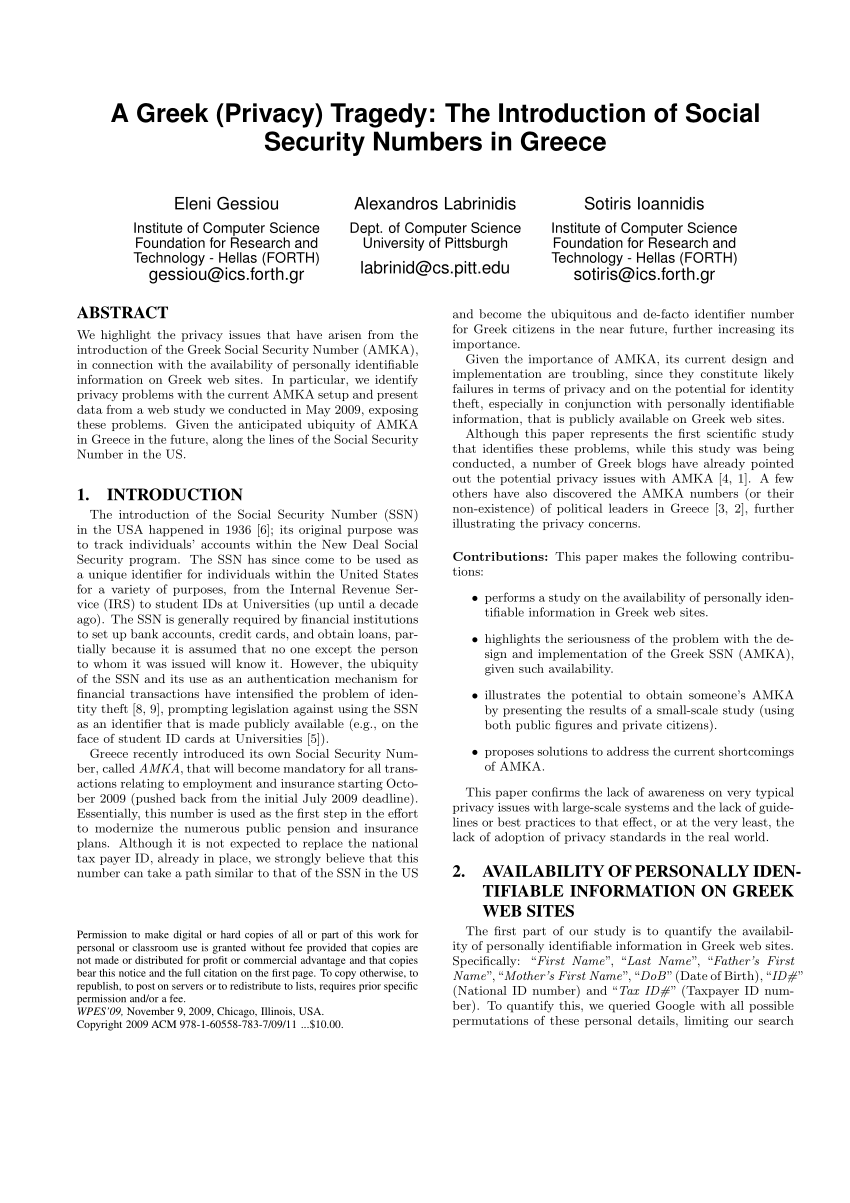

Let me ask you i promise not to do anything bad with your ss# want to post it on cd, we know the answer already. Ewotc allows california employers (or any. The work opportunity tax credit (wotc) was designed with simplicity in mind.

It asks for your ssn and if you are under 40. I've been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the work opportunity tax program. It asks the applicant about any military service, participation in government assistance programs, recent unemployment and other targeted questions.

The wotc program is designed to promote hiring of individuals within target groups, who may face challenges securing employment due to. Work opportunity tax credit questionnaire. Work opportunity tax credit questionnaire employers receive substantial tax credits for hiring certain applicants under the work opportunity tax credit, or wotc, a program created by the u.s.

Work opportunity tax credit 1. I don't feel safe to provide any of those information when i'm just an applicant.' from u.s. Below you will find the steps to complete the wotc both ways.

The work opportunity tax credit (wotc) is a federal tax credit available to employers who invest in american job seekers who have consistently faced barriers to employment. Felons, at risk youth, seniors, etc. Date of birth (if under 40):

Complete two easy forms, make copies of applicant’s driver’s license and social security card, mail them off, and; Applicant information (see instructions on reverse). Is participating in the wotc program offered by the government.

Page one of form 8850 is the wotc questionnaire. However, some companies go on mass hiring sprees, targeting certain populations under these survey to take advantage of the tax credits. (note that certain states and jurisdictions are making the collection of some of this data illegal—it is essential.

Key controversies swirl around employers requiring the social security number (ssn) on a job application, salary requirements when filling out a job application, and salary history or proof of salary at any point in the application and interview process. The work opportunity tax credit program is an incentive for employers to hire new employees from targeted groups of employees. This tax credit is for a period of six months, but it can be for up to 40 percent if the employer.

Becaue the questions asked on that survey are very private, and frankly offensive. The work opportunity tax credit (wotc) can help you get a job. Work opportunity tax credit questionnaire site name/number:

Have you worked for this employer before? Wait for a certification to be mailed back to you. It's asking for social security numbers and all.

Get answers to your biggest company questions on indeed. This tax credit may give the employer the incentive to hire you for the job. The work opportunity credit a see separate instructions.

In box 8, indicate whether the applicant previously worked for the employer, and if yes, enter the last date or approximate last. The forms require your identifying information social security number to confirm who you are, and they ask for your date of birth because some of the target groups are based on age. Some companies get tax credits for hiring people that others wouldn't:

If so, you will need to complete the questionnaire when you apply to a position or after you've been hired (depending on the employer's workflow). Make sure this is a legitimate company before just giving out your ssn though. It also says that the employer is encouraged to hire individuals who are facing barriers to employment.

Some employers integrate the work opportunity tax credit questionnaire in talentreef. Applicant information name (first, mi, last): The wotc forms are federal forms to help determine if you will make your employer eligible for a tax credit when they hire you.

New hires may be asked to complete the wotc questionnaire as part of their onboarding paperwork, or even as part of the employment application in some cases. Its called wotc (work opportunity tax credits). Our wotc tax credit screening can add bottom line savings by screening new hires for tax credit eligibility.

The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a federal tax credit to employers who hire these individuals. Companies are eligible for tax credit as part of this program and hence it works as an incentive for companies to follow the program. Find answers to 'do you have to fill out work opportunity tax credit program by adp?

Big companies want the tax credit and it might be a determining factor in selecting one applicant over another. Wotc (work opportunity tax credit) questionnaire k&s staffing solutions inc. The answers are not supposed to give preference to applicants.

2

Work Opportunity Tax Credit First Advantage

Work Opportunity Tax Credit What Is Wotc Adp

Ppt - Procedures For Austaco Ltd Work Opportunity Tax Credit Program Powerpoint Presentation - Id6408555

Tax Credit Questionnaire Form - Fill Online Printable Fillable Blank Pdffiller

Tax Credit Questionnaire Form - Fill Online Printable Fillable Blank Pdffiller

With Wotc Timing Is Everything - Wotc Planet

Publication 970 2020 Tax Benefits For Education Internal Revenue Service

Pdf A Greek Privacy Tragedy The Introduction Of Social Security Numbers In Greece

Retrotax - Tax Credit Administration Jazzhr Marketplace

What Is A Tax Credit Screening When Applying For A Job - Welp Magazine

Fillable Online Wotc Questionnaire - The Greer Group Inc Fax Email Print - Pdffiller

What Is Tax Credit Screening

Work Opportunity Tax Credit Questionnaire

2

2

2

A History And Education About The Ssn A Better Way To Blog Paymaster

Fillable Online Wotc Form - Rt Employee Forms Fax Email Print - Pdffiller