Japan Corporate Tax Rate 2018

7.0 men multiple of annual gross earnings 2018 japan multiple of annual gross earnings: *1 net sales are presented exclusive of consumption tax.

Lithuania Corporate Tax Rate 2021 Data 2022 Forecast 2006-2020 Historical

First jpy 8 million per annum:

Japan corporate tax rate 2018. Foreign corporations where japanese resident individuals or japanese Tax rates the tax rate is 23.2%. Over jpy 8 million per annum:

The local income tax rates for corporations are 1% on the first krw 200 million, 2% for the tax base between krw 200 million and krw 20 billion, 2.2% for the tax Taxable income < 4 mln <4,8 mln> > 8 mln < 4 mln <4, 8 mln> > 8 mln. Corporation tax rate (%) 1 april 2016:

*2 staff numbers, which are presented as the lower numbers in the “employees” line, include those of unconsolidated subsidiaries accounted for by the equity method as reference data. Details of changes i) definition of frc under the new cfc rules, a frc will be determined by either an “equity ownership test” or a “de facto control test” (i.e. 10% on the first krw 200 million of the tax base 20% up to krw 20 billion 22% up to krw 300 billion 25% for tax base above krw 300 billion for tax years 2018 to 2020, a 20% rate of cash reserve tax is levied on a domestic company (including a

1, 2018, the corporate tax rate was changed from a tiered structure that staggered corporate tax rates based on company income to a flat rate of 21% for all companies. Corporate income tax rate exclusive of surtax. Central government tax /3 19.0 25.5 25.5.

The rates for local taxes may vary somewhat depending on the scale of the business and the local government under whose jurisdiction it is. Final tax return corporations are required to file final returns within two months from the last day of their business year. Tax rate applicable to fiscal years beginning between 1 april 2016 and 31 march 2018.

Japan tax update pwc 2 the new cfc rules will come into force for fiscal periods (of the frc) starting on or after 1 april 2018. The government initially planned to reduce the rate to below 30 percent in fiscal 2017 after cutting it to 31.33 percent in fiscal 2016. In fiscal 2018, it was 26.1 percent in terms of national and local taxes combined (16.0 percent for national tax and 10.1 percent for local tax).

Japan's ratio is lower in comparison with other major industrial countries. In the case that a corporation amends a tax return and tax liabilities voluntarily after the due date, this penalty may not be levied. The corporation tax is imposed on taxable income of a company at the following tax rates:

Companies also must pay local inhabitants tax, which varies with the location and size of the firm. Local corporation tax applies at 4.4% on the corporation tax payable. Combined corporate income tax rate.

Corporate tax rate in japan averaged 40.83 percent from 1993 until 2021, reaching an all time high of 52.40 percent in 1994 and a record low of 30.62 percent in 2019. The tax rates for corporate tax, corporate inhabitant tax and enterprise tax on income (tax burden on corporate income) and per capita levy on corporate inhabitant tax for each taxable year are shown below. L in 2016, the share of corporate tax revenues in total tax revenues was 13.3% on average across the 88 jurisdictions in the database, and corporate tax revenues as a percentage of gdp was 3.0% on average.

At present, japan’s corporate tax rate is 32.11 percent. Since then the rate peaked at 52.8% in 1969. The federal corporate income tax was fist implemented in 1909, when the uniform rate was 1% for all business income above $5,000.

Tax rates for companies with stated capital of more than jpy 100 million are as follows: Steps have been taken, however, to ensure that the tax system does not impose unfair burdens on multinational corporations engaged in economic activities in japan on the basis of the mode of their business presence in japan. Corporation tax is payable at 23.4%.

2018 japan (red) net pension wealth indicator: The basic korean corporate tax rates are currently: For a company with capital of ¥100 million or less, a lower rate of 19% is applied to an annual income of ¥8 million or less.

Financial highlights 2017 2016 2015 2014 2013 for the years ended mar. The rate is increased to 10% to 15% once the tax audit notice is received. Statutory corporate income tax rate in japan, as of april 2014 /1.

L the size of corporate tax revenues relative to total tax revenues and relative to.

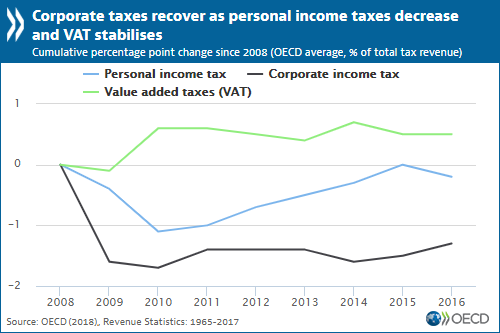

Tax Revenues Continue Increasing As The Tax Mix Shifts Further Towards Corporate And Consumption Taxes - Oecd

Israel Corporate Tax Rate 2021 Data 2022 Forecast 2000-2020 Historical Chart

Estonia Corporate Tax Rate 2021 Data 2022 Forecast 1995-2020 Historical Chart

Corporation Tax Europe 2021 Statista

Indonesia Tax Revenue From Tobacco Excise 2018 Statista

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021-2022 Shimada Associates

Japan General Government Gross Debt To Gdp 2021 Data 2022 Forecast

Corporate Tax Reform In The Wake Of The Pandemic Itep

Real Estate-related Taxes And Fees In Japan

Real Estate-related Taxes And Fees In Japan

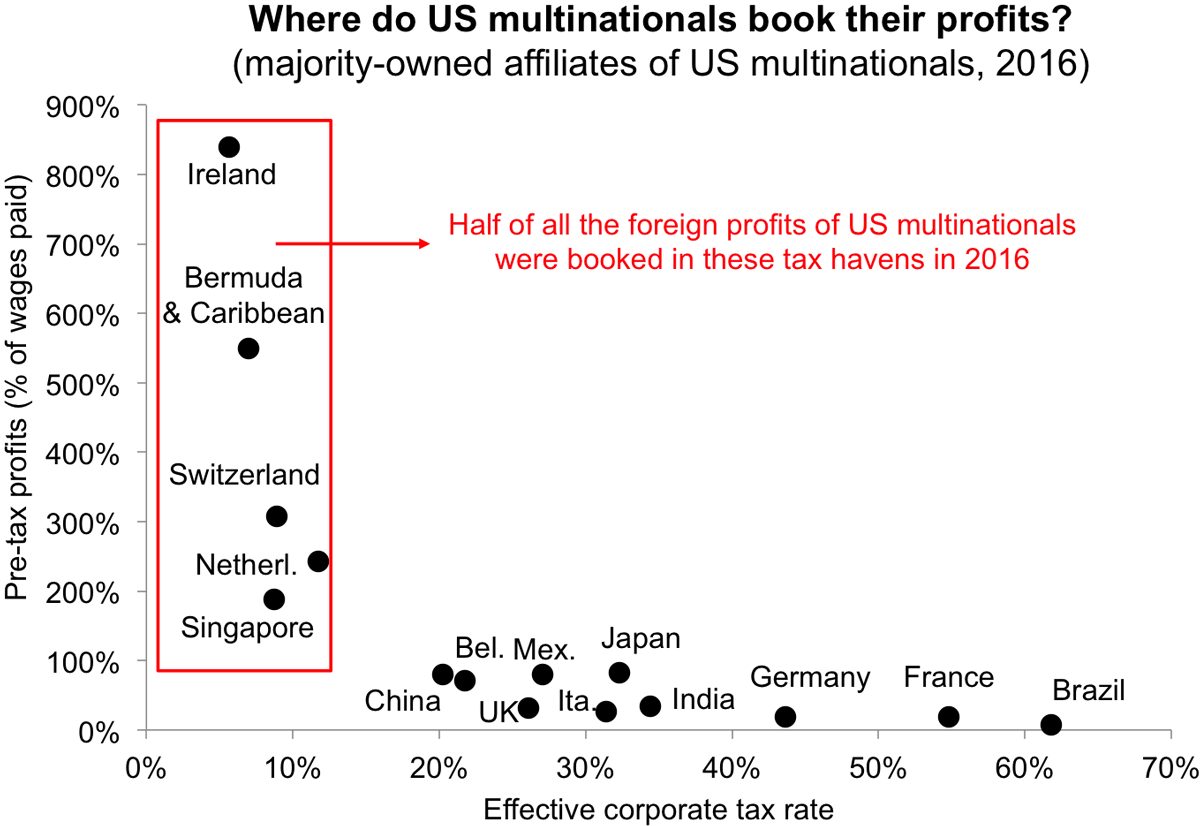

Taxing Multinational Corporations In The 21st Century - Economics For Inclusive Prosperity

Japans Corporate Tax Reform By Abe Government Global Finance Magazine

Corporate Tax Reform In The Wake Of The Pandemic Itep

Going For Growth 2018 - Japan Note - Oecd

Corporate Tax Trends In Europe 2018-2021 Tax Foundation

Tax Revenues Have Reached A Plateau - Oecd

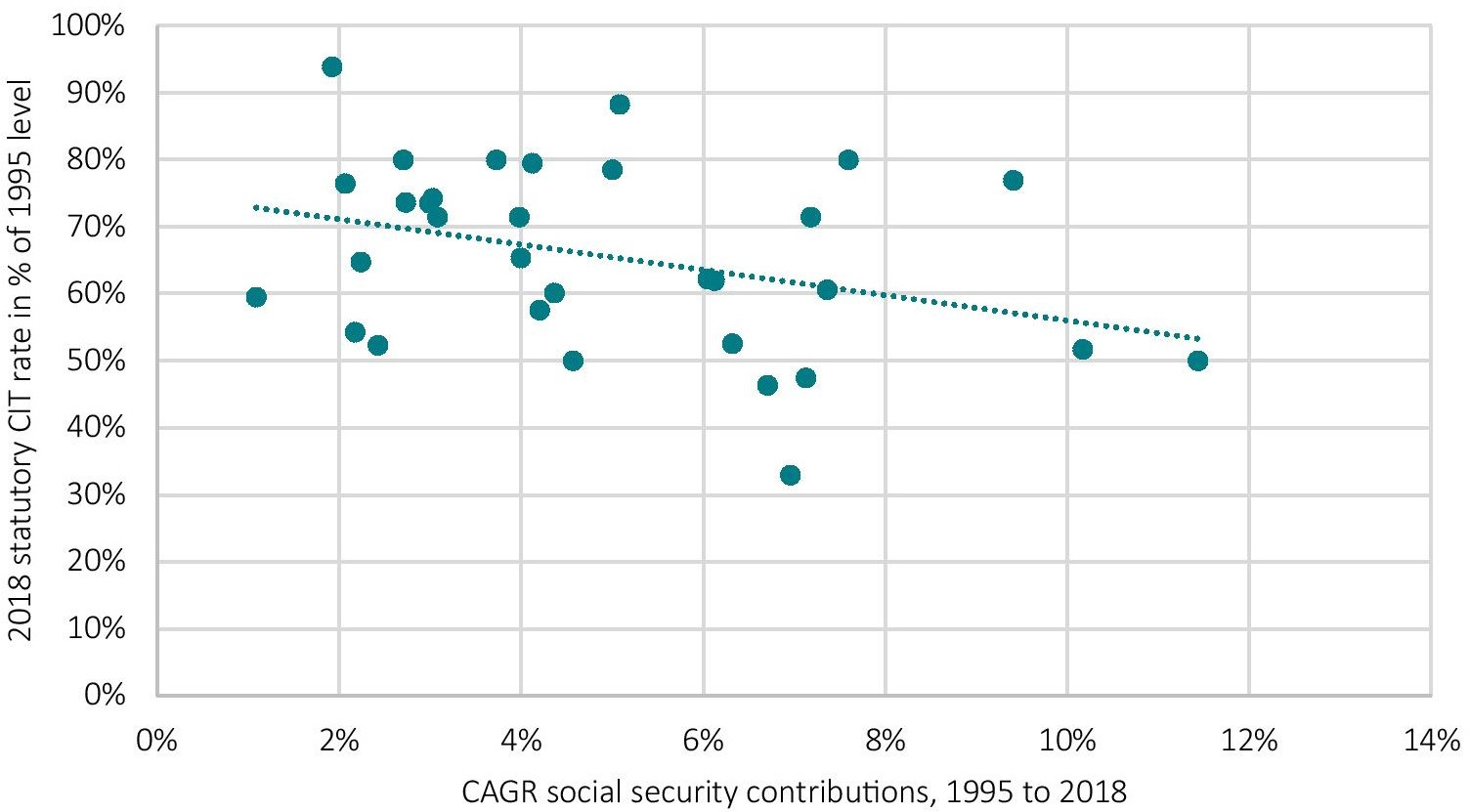

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Japan National Tobacco Excise Tax Revenue 2020 Statista

House Democrats Tax On Corporate Income Third-highest In Oecd