Duluth Mn Sales Tax Calculator

The duluth, minnesota sales tax is 8.38%, consisting of 6.88% minnesota state sales tax and 1.50% duluth local sales taxes.the local sales tax consists of a 1.00% city sales tax and a 0.50% special district sales tax (used to fund transportation districts, local attractions, etc). If the vehicle does not meet both requirements it does not.

Sales Tax Rate Calculator Minnesota Department Of Revenue

Use this calculator to find the general state and local sales tax rate for any location in minnesota.

Duluth mn sales tax calculator. Duluth use tax is line number 321. The vehicle is 10 years or older, and. Additionally, many counties and cities in minnesota levy their own local sales taxes, with rates of up to 2.00%.

Louis county transit sales/use tax (0.5%) and duluth general sales tax (1.5%). Duluth sales tax is line number 320; The minimum combined 2021 sales tax rate for duluth, minnesota is.

Nestled on a corner lot in the heart of congdon, this extensively updated brick & stucco georgian colonial with 5+ bedrooms & 5 baths provides comfort and warmth throughout and. Duluth use tax applies when you are located in the city and you buy items or services without paying the duluth. Each local tax is reported on a separate line of your return.

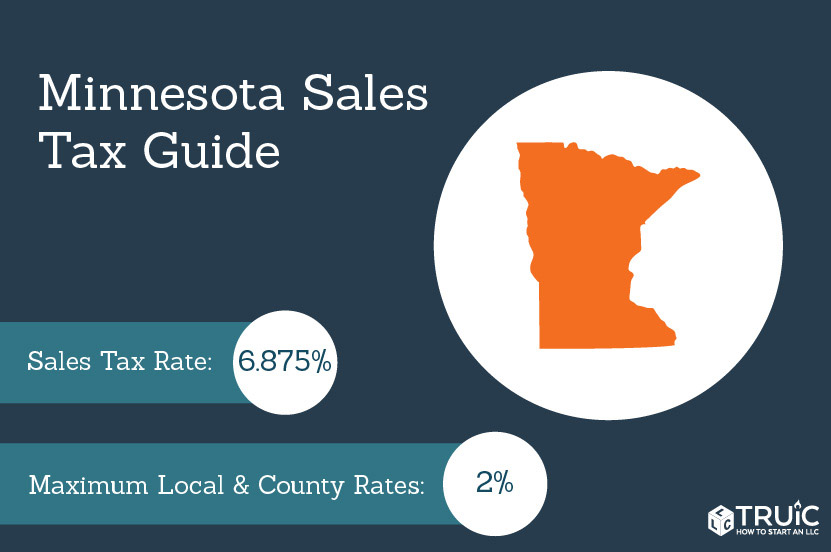

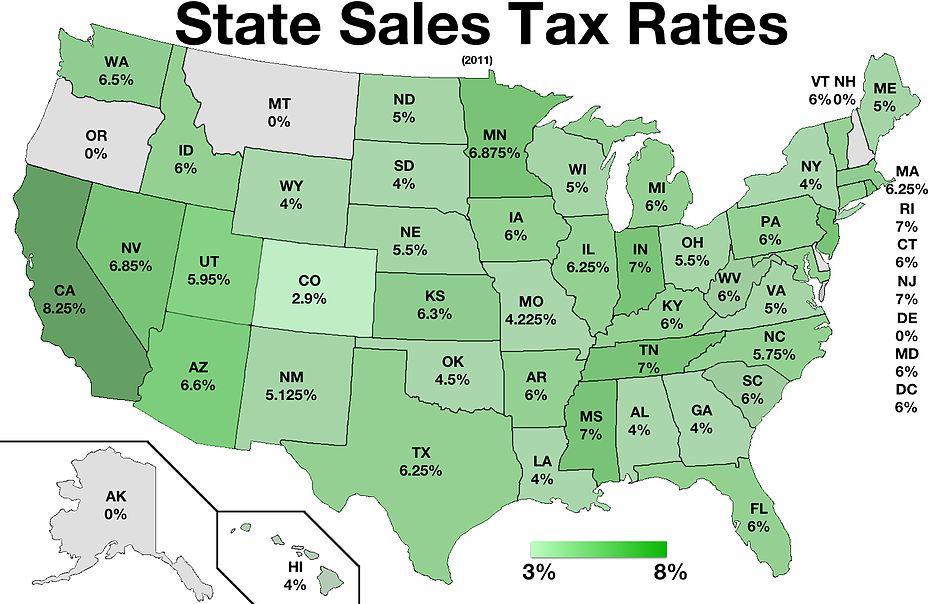

Depending on the zipcode, the sales tax rate of duluth may vary from 8.375% to 8.875% every 2021 combined rates mentioned above are the results of minnesota state rate (6.875%), the duluth tax rate (1% to 1.5%), and in some case, special rate. You can find more tax rates and allowances for duluth and minnesota in the 2022 minnesota tax tables. The state sales tax rate in minnesota is 6.875%.

The duluth, minnesota, general sales tax rate is 6.875%. The results do not include special local taxes—such as admissions, entertainment, liquor, lodging, and restaurant taxes—that may also apply. The minnesota sales tax rate is currently %.

Watch the sunrise, the ships travel under the lift bridge and all the activity in the harbor from the comfort of your living room or while sitting around the backyard firepit of this observation hill property. This amount is in addition to the minnesota sales tax (6.875%), st. See details for 614 w 4th st, duluth, mn, 55806, single family, 3 bed, 3 bath, 1,716 sq ft, $350,000, mls 6100613.

The table below shows the sales tax rates for every county and the largest cities in minnesota. See details for 1238 duluth street, saint paul, mn, 55106, single family, 3 bed, 2 bath, 1,814 sq ft, $334,900, mls 6130036. Real property tax on median home:

The views are amazing from this 3 bedroom, 3 bathroom old meets. The duluth sales tax rate is %. Minnesota has a 6.875% statewide sales tax rate , but also has 407 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 0.422% on.

The december 2020 total local sales tax rate was also 8.875%. The duluth, minnesota sales tax comparison calculator allows you to compare sales tax between all locations in duluth, minnesota in the usa using average sales tax rates and/or specific tax rates by locality within duluth, minnesota. Convenient to both downtowns, this home features three bedrooms, an updated kitchen and bathroom, and a spacious sunroom.

Original woodwork and exposed beams in the living room,. It has a sales price and average value of less than $3,000. This is the total of state, county and city sales tax rates.

Report the duluth sales and use tax when you report your minnesota sales and use tax. Re trans fee on median home (over 13 yrs) auto sales taxes (amortized over 6 years) annual vehicle property taxes on $25k car: Is in move in condition!

The current total local sales tax rate in duluth, mn is 8.875%. Louis county transit sales use tax and duluth general sales tax are paid to the state of minnesota via the minnesota department of revenue website. See details for 2502 e 2nd st, duluth, mn, 55812, single family, 5 bed, 6 bath, 4,100 sq ft, $739,500, mls 6100305.

How 2021 sales taxes are calculated in duluth. The duluth sales tax is collected by the merchant on all qualifying sales made within duluth Sales tax (state & local) sales tax on food:

Duluth in minnesota has a tax rate of 8.38% for 2022, this includes the minnesota sales tax rate of 6.88% and local sales tax rates in duluth totaling 1.5%. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. The county sales tax rate is %.

Minnesota State Income Tax Mn Tax Calculator Community Tax

Minnesota Income Tax Calculator - Smartasset

Tourism Taxes

Property Tax Reports

Minnesota State Income Tax Mn Tax Calculator Community Tax

Sales Taxes In The United States - Wikiwand

Minnesota Sales Tax Rates By City County 2021

Minnesota Income Tax Calculator - Smartasset

Sales Taxes In The United States - Wikiwand

Minnesota Sales Tax Information Sales Tax Rates And Deadlines

Minnesota Sales Tax - Small Business Guide Truic

Minnesota State Income Tax Mn Tax Calculator Community Tax

Minnesota Sales Tax Calculator Reverse Sales Dremployee

Minnesota State Income Tax Mn Tax Calculator Community Tax

2

Sales Taxes In The United States - Wikiwand

Sales Taxes In The United States - Wikiwand

Minnesota State Income Tax Mn Tax Calculator Community Tax

Minnesota State Income Tax Mn Tax Calculator Community Tax