Cook County Use Tax Portal

The financial reports come from many sources, none of which are under the control of the cook county treasurer's office. Cook county tax portal map.

2

For all payment types, first complete the individual use tax transaction form that you received from the cook county department of revenue (dor), with your assigned customer number.

Cook county use tax portal. *if you do not know your. Parking lot and garage operations. Freedom of information act (foia) request.

Sports and recreational equipment and supplies and accessories. For prior tax years and status please check with the cook county clerk’s office for more information. Freedom of information act (foia) request.

*if you do not know your pin, use the search by property address link. To learn more about exemptions that can reduce your tax bill and file an application, visit our exemptions section. Duties and responsibilities of the cook county treasurer.

Property tax bills are sent by the cook county treasurer. Maria pappas, cook county treasurer's resume. The department intends to begin phasing in the use of mydec.

For prior tax years and status please check with the cook county clerk’s office for more information. Upon completion of this topic you will be able to: Maria pappas, cook county treasurer's biography.

The cook county treasurer’s office provides payment status for current tax years and the ability to pay online. Maria pappas, cook county treasurer's biography. Maria pappas, cook county treasurer's resume.

Cook county purchaser individual use tax customers can remit their payments one of three ways to the cook county department of revenue: The new structure imposes a rate of 6% of the charge or fee paid for. Cook county system map to view and create additional maps of the county highway system, visit the interactive cook county highway jurisdiction mapping application created by cook county geographic information systems or the hub for maps, apps and spatial data, at cook central.

By internet, phone or mail. Property tax relief for military personnel. It involves the assessor's office, the board of review, the cook county clerk, and the cook county treasurer.

The department of revenue was established by the cook county board of commissioners. Cook county system map to view and create additional maps of the county highway system, visit the interactive cook county highway jurisdiction mapping application created by cook county geographic information systems or the hub for maps, apps and spatial data, at cook central. Cook county tax portal map.

Update your state tax withholding allowance. The cook county property tax portal is the result of collaboration among the elected officials who take part in the property tax system; You use the tax form function to update federal and state tax details such as filing status, allowances, and exemptions.

For the most part, they are used by the district or agency’s finance officers to review the totals summarized there. Plus, the illinois department of revenue. Property tax relief for military personnel.

Duties and responsibilities of the cook county treasurer. We have more information available on how our property tax system works here. New reports will be added each year in conjunction with tax rate calculations for the second installment of taxes, approximately when the county treasurer mails second installment bills to cook county taxpayers.

The county treasurer’s office is responsible for collecting, safeguarding, investing and distributing property tax funds. In this section, we explain all of it. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in cook county.

The cook county treasurer’s office (ccto) does not guarantee the accuracy or completeness of any of the information contained in any of the financial reports available for downloading from this website. The illinois department of revenue has developed a free online program for your use, called mydec, which will allow you to process real property transfer tax declarations, including authorizing and printing electronic stamps. Cook county | geographic information systems

Prints and mails property tax bills (current & prior) collects property tax payments (current & prior) distributes property taxes to approximately 2,200 taxing bodies The median property tax on a $265,800.00 house is $4,598.34 in illinois. The cook county property tax system is complex.

The cook county treasurer’s office provides payment status for current tax years and the ability to pay online. How much you pay in taxes depends on your property's assessment, assessments of other properties, appeals, exemptions, and local tax levies. Effective september 1, 2013, the cook county board of commissioners approved a change to the structure of the parking tax imposed upon the use and privilege of parking a motor vehicle in or upon any parking lot or garage in the county.

The median property tax on a $265,800.00 house is $2,790.90 in the united states. The excel file below is the cook county assessor's property tax rate simulator tool.

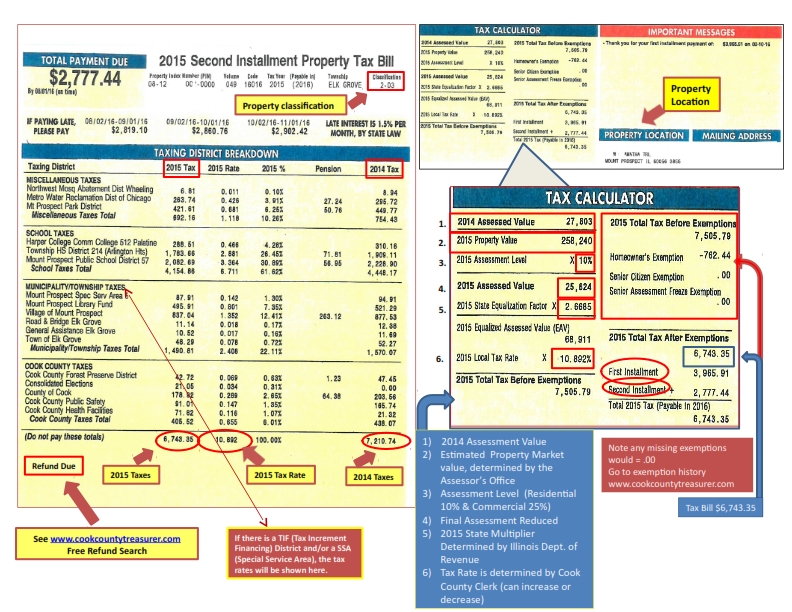

Sample 2nd Installment Tax Bill - Raila Associates Pc

Longtime Homeowner Exemption Cook County Assessors Office

Employee Benefits

.png)

Assessor Kaegi Reminds Property Owners That Many Exemptions Will Auto-renew This Year Due To Covid-19 Cook County Assessors Office

Property Tax Portal - Pin Results Property Property Tax Outdoor Decor

About The Cook County Assessors Office Cook County Assessors Office

Cook County Property Tax Portal Cook County Property Tax Cooking

First Installment Of 2021 Cook County Property Taxes Available Online Chicago Association Of Realtors

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

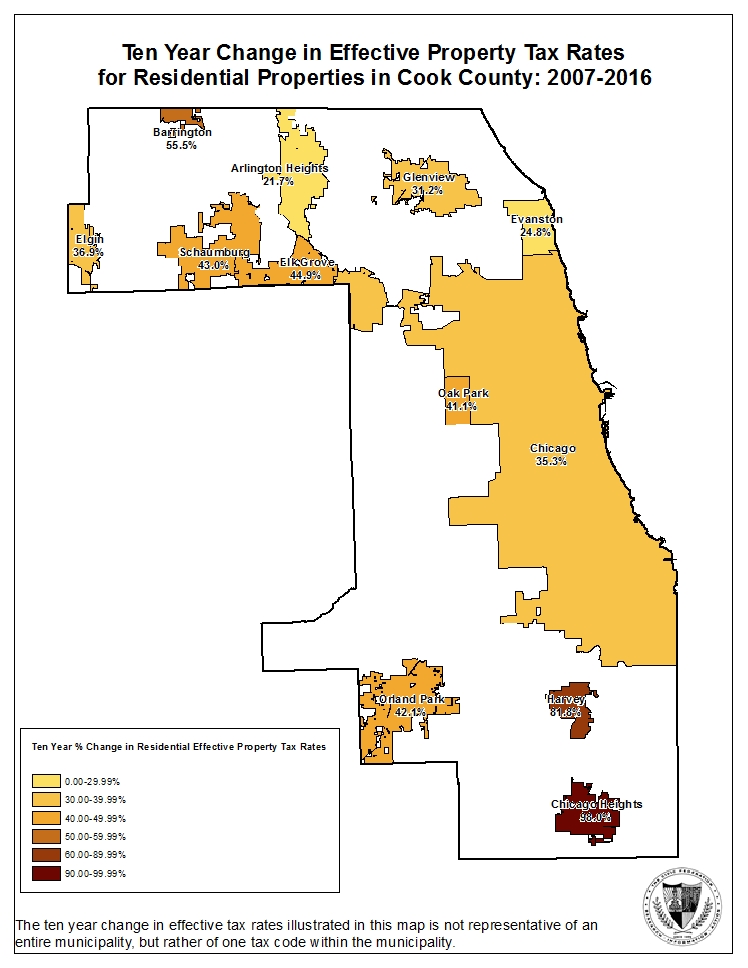

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Incentives Special Properties Cook County Assessors Office

Home Page

Ten-year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Estimated Full Value Of Real Property In Cook County 2008-2017 The Civic Federation

Ten-year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

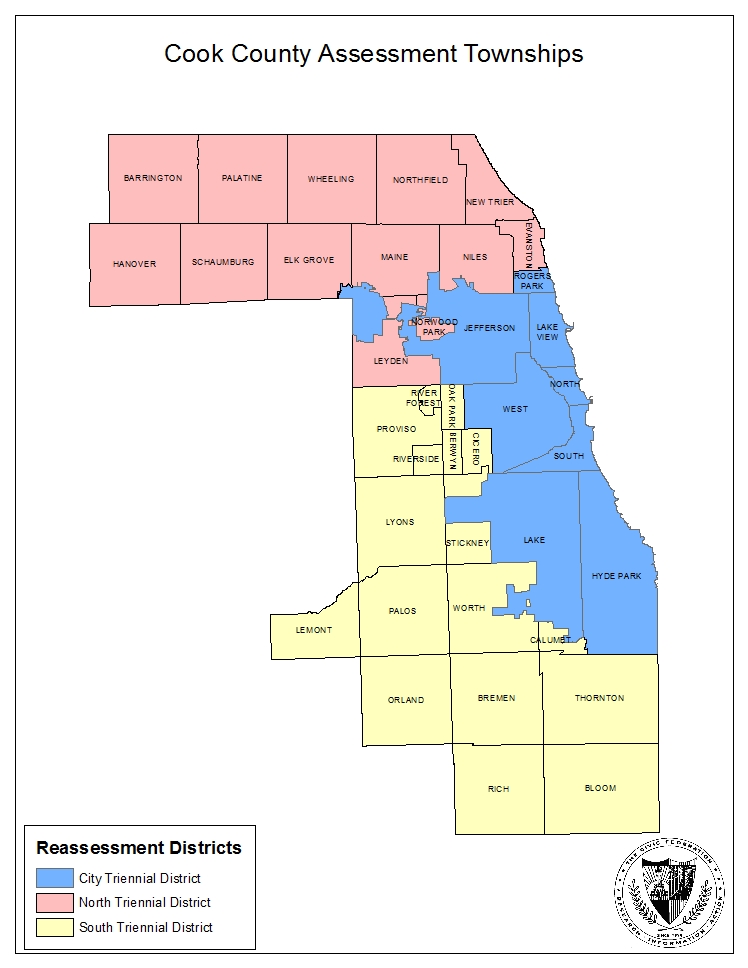

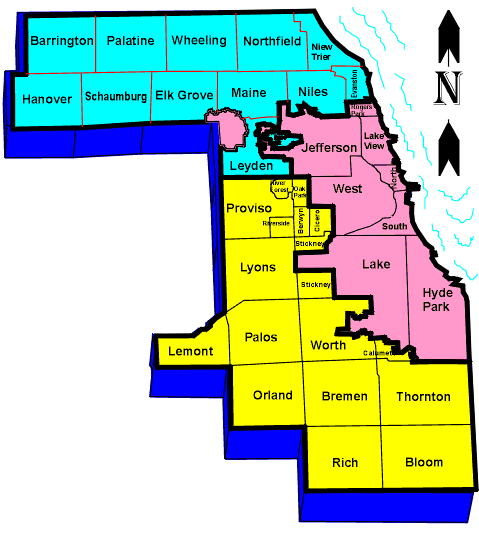

Cook County Assessment Townships Maps - Raila Associates Pc

The Cook County Property Tax System Cook County Assessors Office

Cook County Viewer

Cook County Property Tax Portal Property Property Tax Real Estate Career