Sacramento Property Tax Rate 2021

To consider adopting increases to the city’s recycling, solid waste, and street sweeping services rates. It's also home to the state capital of california.

Sacramento-county Property Tax Records - Sacramento-county Property Taxes Ca

The sacramento sales tax rate is %.

Sacramento property tax rate 2021. The property crime rate in sacramento is 3,182.1 per 100,000 people. The california sales tax rate is currently %. The city will hold a second reading at its.

Payments may be made by mail or in person at the county tax collector’s office located at 700 “h” street, room 1710, sacramento, ca 95814, between the hours of 8 a.m. Additional exemptions might be available for farmland, green space, veterans, or others. Housing experts expect them to jump even higher in 2021 as many communities.

What is the sales tax rate in sacramento, california? The sacramento county tax assessor can provide you with an application form for the sacramento county homestead exemption, which can provide a modest property tax break for properties which are used as the primary residence of their owners. That’s up from 56% of counties in the third quarter of 2020 and marks the worst rate since 2008.

31, 2021, additional collection costs and monthly penalties at the rate of 1.5 percent will be added to the base tax. Compilation of tax rates by code area. Personal property tax rates will decrease from 73.46 cents to 65.9 cents per $100 of assessed valuation.

And 36.50% higher than the california property crime rate of 2,331.2 per 100,000 people. Total statewide base sales and use tax rate : The city of sacramento will hold a virtual public hearing before the utilities rate advisory commission on november 17, 2021 at 5:30 p.m.

Hence, the median property taxes paid for such homes are about $2,412.in the table below, we will go over each state and see how it compares to the american median figures. This does not include personal (unsecured) property tax bills issued for boats, business equipment, aircraft, etc. That compares to a 1 in 47.4 chance nationally.

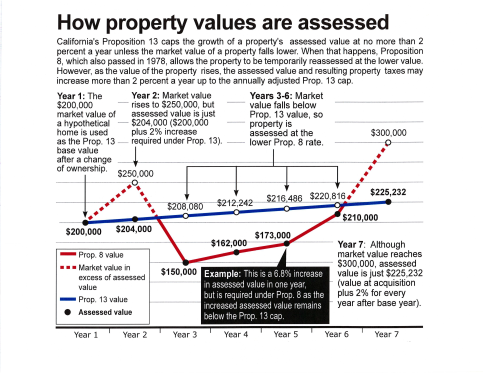

The amount of property tax owed depends on the appraised fair market value of the property, as determined by the property tax assessor. 13 capped the statewide property tax rate at 1%, limited annual increases in assessed value to a maximum of 2% until there was a change of. Average property taxes paid rose 4% in 2020, according to data from real estate information firm attom data solutions.

Property tax is calculated by multiplying the property's assessed value by all the tax rates applicable to it and is an estimate of what an owner not benefiting of any exemptions would pay. That's 50.82% higher than the national rate of 2,109.9 per 100,000 people. The property tax rate in the county is 0.78%.

This is the total of state, county and city sales tax rates. Emerald hills (redwood city) 9.875%: The minimum combined 2021 sales tax rate for sacramento, california is.

The typical property owner’s property tax rate is 1.1 percent. If a tax bill remains unpaid after oct. The county sales tax rate is %.

In the year a new owner takes over a property, its taxable. Sacramento county is located in northern california and has a population of just over 1.5 million people. Percentage of home value median property tax in dollars.

450 n street, sacramento, california. To the taxable value of their property multiplied by their property tax rate. The state collects a personal.

Effective property tax rates by state. The county’s real property tax rate has held steady at $1.15 per $100 of assessed value since fiscal 2019 — though it will decline to $1.14 in 2022. The tax rates are expressed as dollars per 100 of assessed value, therefore the tax amount is already divided by 100 in order to obtain the correct value.

City level tax rates in this county apply to assessed value, which is equal to the sales price of recently purchased homes. The local sales tax rate in sacramento county is 0.25%, and the maximum rate (including california and city sales taxes) is 8.75% as of november 2021.

What Is Kcm Real Estate Infographic Real Estate Information Real Estate Tips

Landlords Spreadsheet Template Rent And Expenses Spreadsheet Etsy In 2021 Rental Property Management Being A Landlord Spreadsheet Template

Sacramento-county Property Tax Records - Sacramento-county Property Taxes Ca

3745 Las Pasas Way Sacramento Ca 95864 Mls 19036325 Zillow Home Loans Home Inspector Zillow

Services Rates - City Of Sacramento

Crime - City Of Sacramento

Top 4 Gift And Estate Tax Avoidance Strategies Estate Tax Estate Planning Estate Planning Attorney

Expired Script - Tom Ferry Real Estate Advice Real Estate Tips Real Estate Memes

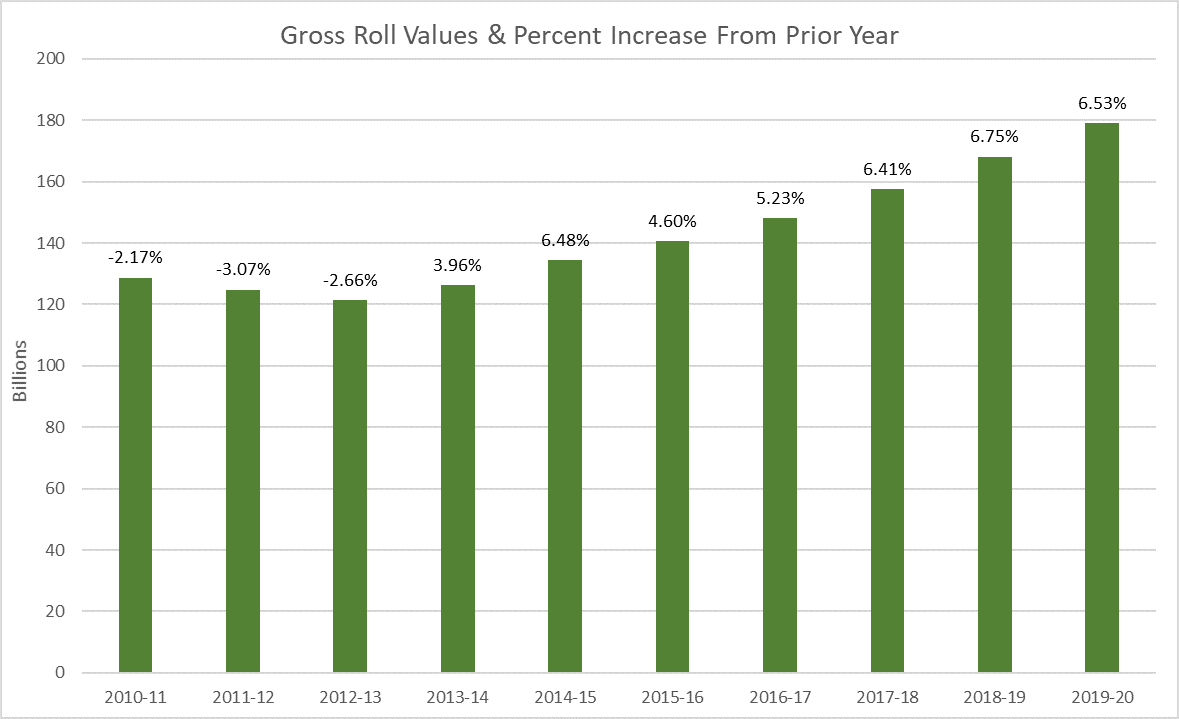

2019-20 Sacramento County Property Assessment Roll Tops 179 Billion

Sacramento-county Property Tax Records - Sacramento-county Property Taxes Ca

Opportunity Zones

Would Teachers Strike In Clark County Mirror Labor Wins Elsewhere Teachers Strike School District Boards National Education Association

Map Of City Limits - City Of Sacramento

Cal State Sacramento Interior Design School Interior Design Companies Interior Design Degree

How To Get Your First Credit Card In 2021 Credit Card Infographic Credit Card Application Credit Card

2019-20 Sacramento County Property Assessment Roll Tops 179 Billion

2

Lp3varr5tcauim

Sacramento-county Property Tax Records - Sacramento-county Property Taxes Ca