German Tax Calculator For Foreigners

Germany germany's pension system tricky for foreigners. To improve the economic situation and infrastructure for certain regions in need, the german government has been levying a 5.5% solidarity surcharge tax.

Income Tax In Germany For Expat Employees Expatica

The maximum tax rate is 45% and only applies for incomes exceeding 250,730 euros a.

German tax calculator for foreigners. The basic principal is that income is divided between couples to calculate income tax liability. Taxes are levied by the federal government (bundesregierung), federal states (bundesländer) and municipalities (gemeinden).tax administration is shared between two taxation authorities: If you have been present in germany for over 183 days.

The surcharge is imposed as a percentage on all individual income taxes. Geometrically progressive rates start at 14% and rise to 42%. The basic tax rate is 0.35%, multiplied by a municipal factor.

The german state is responsible for funding kindergartens and. Urtaxlounge llc is the best place to go for german tax refund and social security refund. Generally speaking, the higher your taxable income in germany, the higher your rate of taxation.

You want to quickly calculate the probable amount of your income tax when working in germany? I had businesses with bhoomika and team on two occasions (tax refund and pension refund). As of 1 january 2021 the application of the solidarity surcharge tax has been substantially.

Whether you’re a german citizen or an expat, you are required by law to pay taxes if you earn money while living or working in germany. This program is a german wage tax calculator for singles as well as married couples for the years 2010 until 2019. The income tax on an income of € 50,000 for a single person would be € 13,483 (tax rate:

Both the times their service is more than satisfactory. Online calculators for german taxes. The german income tax calculator is designed to allow you to calculate your income tax and salary deductions for the 2020 tax year.

The average tax burden is significantly lower. German income tax calculator this program is a german income tax calculator for singles as well as married couples for the years 1999 until 2019. Each time we go to a supermarket or café, drop by at a gas station or receive a payroll, we are paying taxes.

About the 2020 german income tax calculator. The exact amount of a tax in germany and its calculation method are determined by the finanzamt, an organization performing the functions of the tax service, on the basis of the previously submitted tax return. Easily calculate various taxes payable in germany.

Gross salary of one spouse of eur 100,000, other spouse has no income. The german income tax is € 18,530 (€ 50,000. The maximum income tax rate is 45% plus solidarity surplus charge of 5.5% on income tax.

The additional ‘solidarity surcharge’ is the solidaritätszuschlag that helps finance the costs related to german unification and amounts to 5.5 per cent of your income tax. The calculator is provided for your free use on our website, whilst we aim for 100% accuracy we make no guarantees as to the accuracy fo the calculator. As you can see above the tax allowance is double for a married person.

But, if they return home, they can face a tough time. This income tax calculator is best suited if you only have income as self employed, from a trade or from a rental property. Therefore the combined maximum rate is 47.5%.

More foreigners are paying into germany's social security system than ever before. Interactions with the finance authorities is almost always something we want to avoid. The income tax rate for a foreigner with gross salary of €40,000, on the other hand, is estimated to be 36 per cent.

The effective tax rate is usually between 1.5% and 2.3%. In addition german tax law is less strict concerning the deduction of income related expenses compared to most neighbouring countries. The federal central tax office (bundeszentralamt für steuern) and the.

If you are married, then you may get considerable income tax advantages in germany. Note 1 on 2021 german income tax tables: Use our income tax calculator to calculate the.

Taxation is the primary source of revenue for the state and enables the government to perform its duties. From a taxable income of € 250,731/€ 501,462 (single/married taxpayers), the tax rate is 45 %. The tax burden on lower or average income is endurable.

An employee with an yearly income of 9.744 € won’t have to pay income tax, for married employees the limitation will be 19.488 €. What types of tax should i pay? The resulting base amount is further multiplied by municipal coefficients to calculate for.

26.97%), but a’s income tax rate will be calculated on the basis of € 120,000 (income taxable in germany of € 50,000 + foreign source income of € 70,000). This is a sample tax calculation for the year 2021. The tax rate on € 120,000 is 37.06%.

Solidarity surcharge (solidaritaetszuschlag), capped at 5.5% of your income tax. Property taxes (grundsteuer) real estate tax is levied on real estate in germany. Married couple with two dependent children under age 18 years.

However, doing your tax return in germany can not only be super easy, but also prove to be quite profitable. The tax base is the assessed value of the property. This wage tax calculator is best suited if you receive a salary only as an employee on a german payroll.

The base tax rate is 14 %, rising progressively to 42 % for a taxable income of € 52,882/€ 105,764 (single/married taxpayers).

Your Bullsht-free Guide To Taxes In Germany

How To Create An Income Tax Calculator In Excel - Youtube

Singapore Tax Rate Personal Individual Income Tax Rates In Singapore Updated

What Are Marriage Penalties And Bonuses Tax Policy Center

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

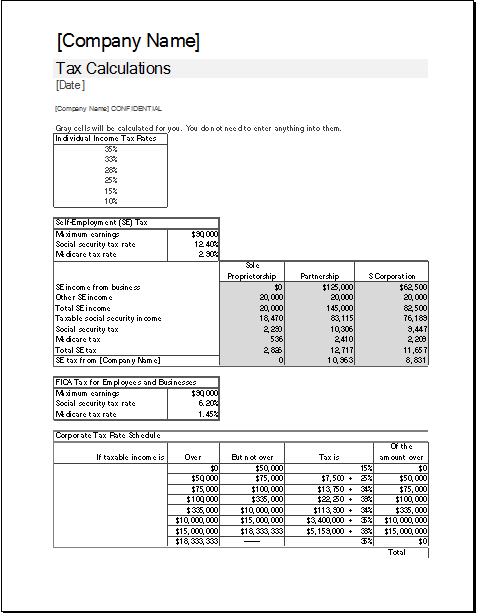

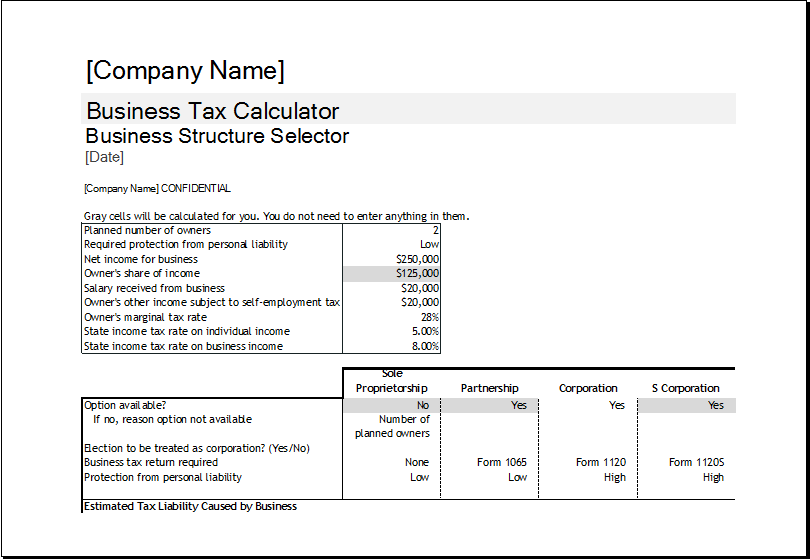

Corporate Tax Calculator Template For Excel Excel Templates

German Wage Tax Calculator Expat Tax

Your Bullsht-free Guide To Taxes In Germany

Tax Class In Germany Explained Easy 2021 Expat Guide

Excel Formula Income Tax Bracket Calculation Exceljet

German Income Tax Calculator Expat Tax

Corporate Tax Calculator Template For Excel Excel Templates

Uk Income Tax Calculator - December 2021 - Incomeaftertaxcom

German Income Tax Calculator Expat Tax

German Tax Calculator Easily Work Out Your Net Salary - Youtube

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Foreigners Income Tax In China China Admissions

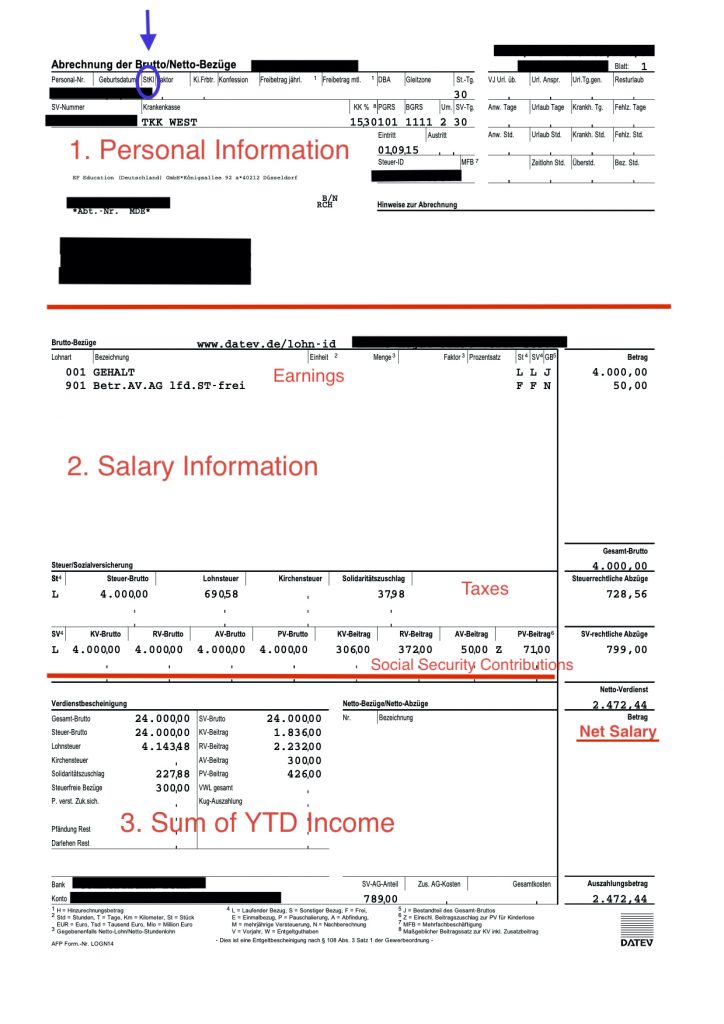

Salary Taxes Social Security

How To Calculate Foreigners Income Tax In China China Admissions