When Are Property Taxes Due In Illinois 2019

Assuming a tax rate of $9.8487 per $100 of eav, the amount of property tax due would be $7,616.30, calculated as follows: (late payment interest waived through monday, may 3, 2021) tax sales.

Ten-year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

For instance, 2019 taxes are billed and due in 2020.

When are property taxes due in illinois 2019. See how your individual property taxes are distributed (for any parcel) and how to contact those taxing bodies on lake county's tax distribution website. All 102 counties in illinois are considered disaster areas by both the state and. Elmhurst public library, to be approved by the city council.

To avoid any late penalty, the payment must be made on or before june 4th, 2021. Under illinois law, areas under a disaster declaration can waive fees and change due dates on property taxes. The due date for the first installment of the property tax bill is coming up fast — on june 3.

Learn how the county board has. Employer contributions to the police officers’ and firefighters’ pension funds. In some areas, this figure can be upwards of $6,000 per year.

Clicking on the links with this symbol ( ) will take you to a county office or related office with its own website while the links without the symbol belongs to a department maintaining webpages within the county site itself. County farm road, wheaton, il 60187. 2018 tax bills will be mailed may 28, 2019.

Corporate purposes (general fund), including amounts for fire protection, ambulance services, and imrf. The typical homeowner in illinois pays $4,527 annually in property taxes. Property tax due dates for 2019 taxes payable in 2020:

The second installment for the 2018 property taxes paid in 2019 is sept. A united states postal service postmark is accepted as date of payment in the calculation of a late penalty. Welcome to jo daviess county, illinois.

Questions answered every 9 seconds. Remember to set the tax year in the column to the right. The city annually levies a property tax on the assessed valuation of each property.

Questions answered every 9 seconds. For tax year 2019 (payable in 2020) all assessments were finalized by july 31, 2019 and board of review appeals were completed by december 31, 2019. View maps of different taxing districts in lake county's tax district map gallery.

In most counties, property taxes are paid in two installments, usually june 1 and september 1. We are now accepting payments on line, in the office, through the mail, and at any hancock county bank. Payment stubs with bar code must accompany.

Tax year 2020 first installment due date: County boards may adopt an accelerated billing method by resolution or ordinance. Beginning may 1, 2021 through september 30, 2021, payments may also be mailed to:

2018 real estate property taxes payable 2019 due dates: From left to right, aurora mayor richard irvin, kane county clerk john cunningham, kane county treasurer david rickert. After any qualified property tax exemptions are deducted from the eav, your local tax rate and levies are applied to compute the dollar amount of your property taxes.

Ad a tax advisor will answer you now! 2nd installment due september 3, 2019. $77,333.33/100 x $9.8487 = $7,616.30 of this amount due, the united city of yorkville would receive $454.87 (6%) where does your property tax go?

The statewide average effective tax rate is 2.16%, nearly double the national average. Taxes are payable the calendar year after the tax year. Amounts are accessible on our website.

2019 real estate tax bills. Champaign county assessments were sent to the illinois department of revenue for their review in february 2020. Welcome to property taxes and fees residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section.

The median property tax in illinois is $3,507.00 per year for a home worth the median value of $202,200.00. For example, payment for 2019 taxes is due in calendar year 2020. Illinois has one of the highest average property tax rates in the country, with only six states levying higher property taxes.

First installment is due june 28, 2019 and second installment is due september 6, 2019. Tax year 2020 second installment due date: For mobile homes only, set the tax year to the calendar year for which taxes are due.

Property tax bills are mailed twice a. 1st installment due june 3, 2019. Enjoy online payment options for your convenience!

The charts below give a breakdown of where your property tax money goes by taxing district Payments and correspondence may always be mailed directly to the dupage county treasurer's office at 421 n. Welcome to madison county, illinois.

Learn more about mydec or to find additional information. Ad a tax advisor will answer you now! Counties in illinois collect an average of 1.73% of a property's assesed fair market value as property tax per year.

If the tax bills are mailed late (after may 1), the first installment is due 30 days after the date on your tax bill. Illinois lawmakers introduce bills to delay property tax payments. Each tax year's property taxes are billed and due the following year.

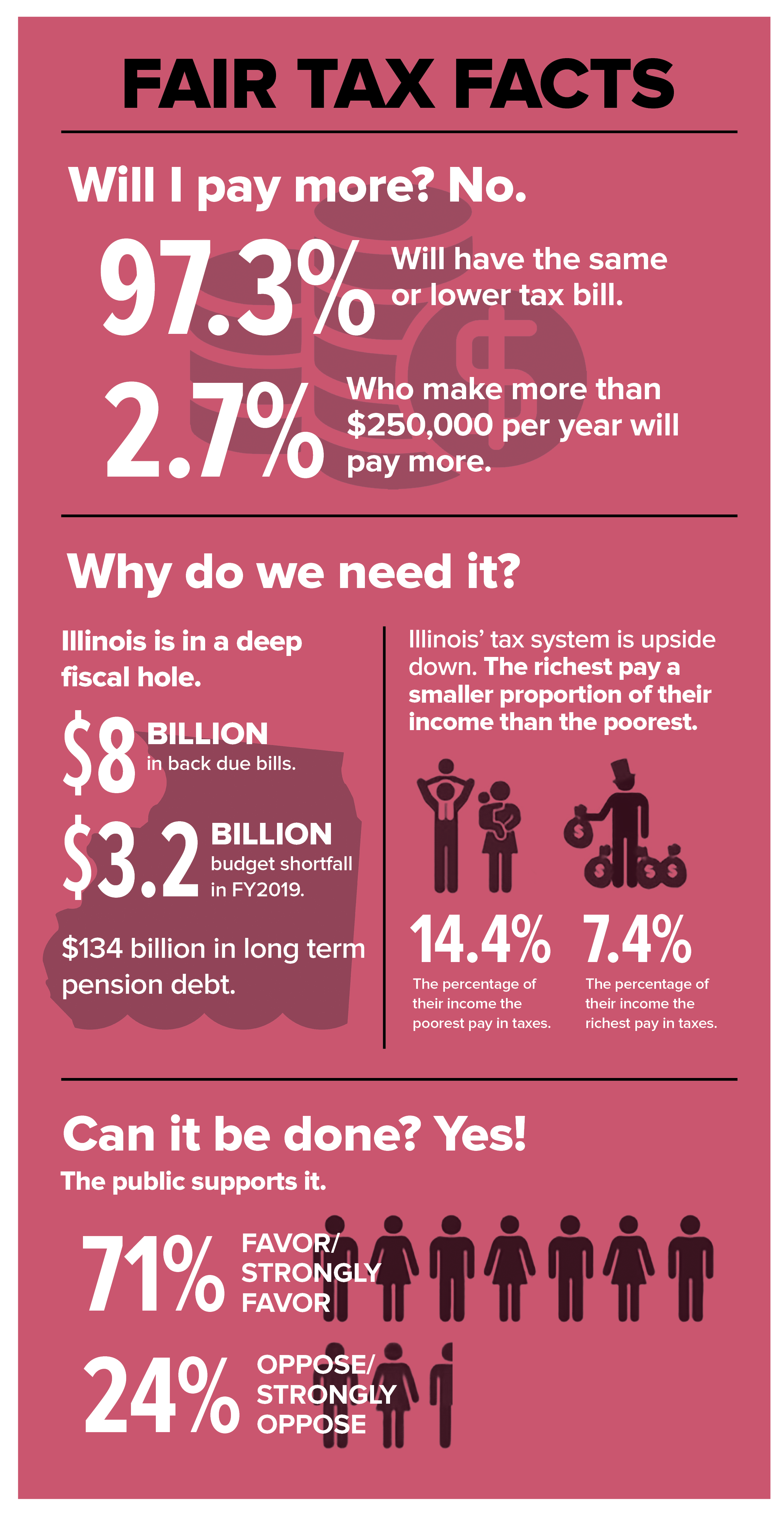

Illinois Needs Fair Tax Reform - Afscme Council 31

Increasing Property Taxes Impact Land Owner Returns And Equilibrium Land Values Farmdoc Daily

Homes For Sale In Deboer Woods Homer Glen Illinois Frankfort Connecticut Waterfront Homes For Sale

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

Pin On Blnnewscom

Illinois Income Tax Rate And Brackets 2019

The Cook County Property Tax System Cook County Assessors Office

Illinois Taxes - Illinois Economic Policy Institute Illinois Economic Policy Institute

Httpsirstaxproblemresolutionwordpresscom Illinois State Tax Income Taxes Il Dept Revenue Rate Income Tax Return Tax Return Tax Payment

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Time For Advance Tax Payment Capital Gains Tax Filing Taxes Tax Time

Illinois Taxes - Illinois Economic Policy Institute Illinois Economic Policy Institute

Irs Tax Refund Status Illinois Residents Still Waiting For Federal Tax Refunds 9 Months After Filing - Abc7 Chicago

Illinois Fair Tax Explained - The Depaulia

An Examination Of Counties In Illinois The Civic Federation

Property Tax - City Of Decatur Il

Amended 2019 Lake County Property Tax Bills Lake County Il

The Cook County Property Tax System Cook County Assessors Office

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation