Rhode Island State Tax Form 2021

The current amount of rhode island taxes being withheld from his pay. Enter amount due and paid $ 0 0 your social security number

Latest And Past Winning Numbers Of The Rhode Island Lottery The Lottery Lab State Lottery Lottery Winning Numbers

We last updated rhode island form 1040es from the division of taxation in february 2021.

Rhode island state tax form 2021. Selecting option #3, or by visiting the rhode island division of taxation’s website at www.tax.ri.gov. Details on how to only prepare and print a rhode island 2021 tax return. Groceries, clothing and prescription drugs are exempt from the rhode island sales tax.

Claim for refund of temporary disability insurance tax with instructions. Detailed rhode island state income tax rates and brackets are available on this page. Estimated individual income tax return.

Rhode island usually releases forms for the current tax year between january and april. Click on the appropriate category below to access the forms and instructions you need: The ri tax forms are below.

Printable rhode island state tax forms for the 2020 tax year will be based on income earned between january 1, 2020 through december 31, 2020. The rhode island tax filing and tax payment deadline is april 18, 2022. Enter amount due and paid $ 0 0 your social security number

Reporting rhode island tax withheld: State of rhode island 2021 benefits guide • 2. All forms supplied by the division of taxation are in adobe acrobat (pdf) format;

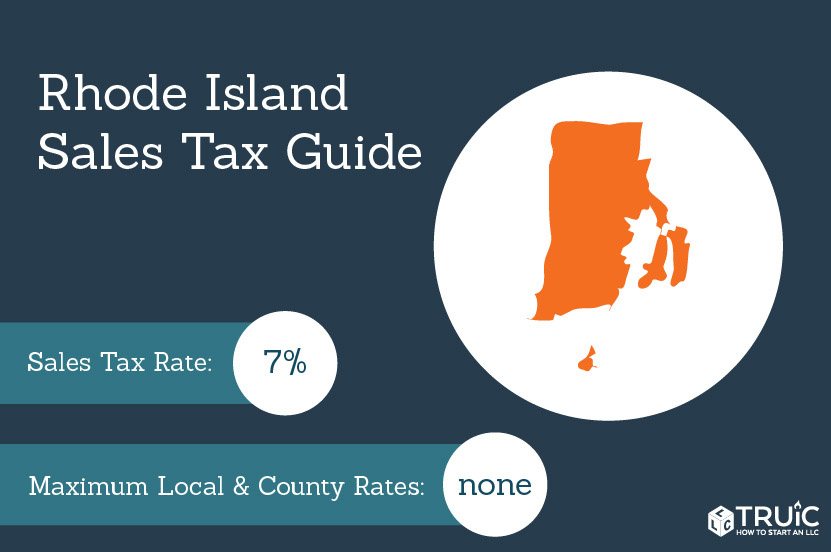

This benefits guide includes an overview of your benefits, with information on how to save—and even earn—extra dollars with some simple choices. The rhode island state sales tax rate is 7%, and the average ri sales tax after local surtaxes is 7%. Complete the respective form(s) below, sign, and.

Selecting option #3, or by visiting the rhode island division of taxation’s website at www.tax.ri.gov. 2021 rhode island state use tax. The ri use tax only applies to certain purchases.

The rhode island income tax has three tax brackets, with a maximum marginal income tax of 5.99% as of 2021. 2021 rhode island state sales tax. The rhode island use tax is a special excise tax assessed on property purchased for use in rhode island in a jurisdiction where a lower (or no) sales tax was collected on the purchase.

Most forms are provided in a format allowing you to fill in the form and save it. To have forms mailed to you, please call 401.574.8970 or email tax.forms@tax.ri.gov; You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding.

Rhode island income tax forms. 2021 rhode island state tax tables. Ad easily edit, fill in and sign pdf forms and agreements online using the best pdf signer!

The state of rhode island is proud to offer state employees a comprehensive benefits package that provides flexibility and choice. Rhode island state income tax forms for tax year 2021 (jan. The rhode island income tax rate for tax year 2020 is progressive from a low of 3.

Termination of employment security registration. We also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for each state. Exact tax amount may vary for different items.

Employers must report and remit to the division of taxation the rhode island income taxes they have withheld on the following basis: The rhode island state tax tables for 2021 displayed on this page are provided in support of the 2021 us tax calculator and the dedicated 2021 rhode island state tax calculator.

2

3 Tips For Filing Taxes In Multiple States Credit Karma Tax

District Of Columbia Aca Reporting Requirements Health Care Coverage Health Insurance Coverage Rhode Island

How To Get A Resale Certificate In Rhode Island - Startingyourbusinesscom

Free California 3 Day Notice To Quit - Incurable Pdf Word Template 3 Day Notice Eviction Notice Rental Agreement Templates

9fuy9cdi64dbym

Rhode Island Sales Tax - Taxjar

Rhode Island Income Tax Brackets 2020

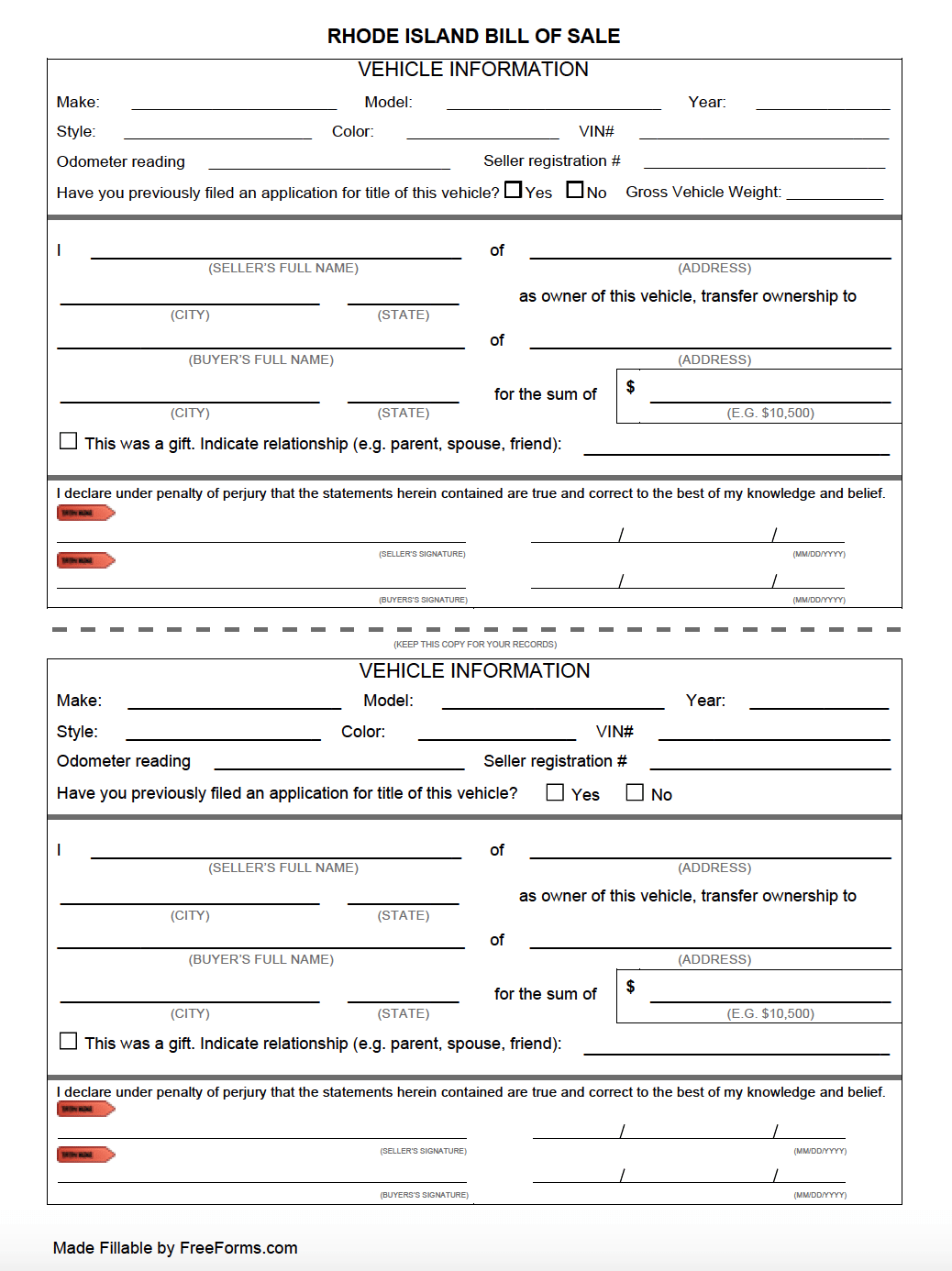

Free Rhode Island Bill Of Sale Forms Pdf

Rhode Island Income Tax Calculator - Smartasset

Pin On Fyi

2

Rhode Island Income Tax Calculator - Smartasset

Rhode Island Sales Tax - Small Business Guide Truic

Covid-19 Information Ri Division Of Taxation

Rhode Island Minimum Wage 2021 - Minimum-wageorg

Rhode Island Notice Of Deficiency Letter Sample 1

Rhode Island Income Tax Calculator - Smartasset

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog