Indiana Excise Tax On Boats

Lake and river enhancement (lare) fee: The value is reduced 10% each year up to a 50% reduction of your boat's original value.

Indiana Boat Registration Instructions Dmvorg

Varies according to your boat's excise class—see the lare fee chart for details.

Indiana excise tax on boats. Unless you drive it on the roadways, then you must title your vehicle. Lake and river enhancement (lare) fee: Some indiana boat owners can expect high excise tax.

Title & registration renewals & replacements. Personal watercraft also are required to display the registration number and. Except as provided in section 7.2 of this chapter, such excise tax shall be due on or before the regular annual registration date in each year on or before which the owner is required under the motor vehicle registration laws of indiana to register vehicles and such excise tax shall be paid to the bureau at the time the vehicle is registered by.

Excise tax must be paid on vessels registered in another state if the vessel is used, operated, docked or. Indiana and federal boating laws are presented in this handbook in a summarized form. Trailers with a declared gross weight of 9,000 pounds.

The amount of boat excise tax you will pay every year is based on your boat's age and size and how much your boat was worth when it was new. $1 goes to the state of indiana, $1 to the host city, and $1 to the host county. (d) a boat may be operated, used, docked, or stored in a county

Indiana law requires owners of vessels that are operated, used, docked, or stored in indiana to pay the boat excise tax. The supplemental (admission) tax in indiana is $3 per person. Definition of an abandoned and/or derelict vessel

The age of a watercraft is measured in years and is counted from the manufacturer's model year. This is paid annually when the watercraft is registered. Boat and motor or boat only:

If you own a sailboat or motorboat that is registered, operated, docked, or stored in indiana, you are required to pay the annual boat excise tax. These requirements also apply to personal watercraft (pwcs). Their bill for state excise taxes just got higher.

The casual excise tax for a boat or boat and motor purchased as a package is 5% of purchase price with a maximum fee of $500.00. Varies from in county to county. The amount of this tax is based on the watercraft class and age.

Definition for “boat” for the purposes of administering excise tax collection under ind. Lake and river enhancement fee: Vehicles registered as military vehicles are charged a flat rate vehicle excise tax of $8.00.

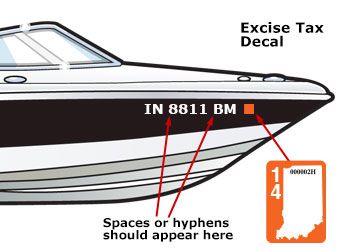

Along with registration, boats must include excise tax decals showing that the boat owner has paid the necessary tax during registration. Owners of motorboats and sailboats that are used, operated, docked or stored in indiana are required to pay boat excise tax. Depends on the vessel’s age and class;

Owners will then receive two excise tax decals that are valid for one year and must be displayed on the vessel. Excise tax decals must be affixed on both sides of the bow, to the right of and within three inches of the number. Boat excise tax must be paid annually.

Varies from in county to county. Purchase price x.05, the maximum tax is $500. The excise tax amount is based on the value of the vessel when new.

More than 300 people with boats moored in. Boat excise tax.23 fees related to registering required equipment a boat or pwc.24 titling your boat or pwc.24 display of number. Means any device in which a person may be transported upon water and includes every motorboat, sailboat, pontoon boat, rowboat, skiff, dinghy, or canoe, regardless of size.

When it comes to flat rates, the north carolina sales tax on boats is 3 percent but capped at $1,500, and in new jersey it’s 3.3125 percent, but in florida it’s 6 percent, and in texas it’s 6.25 percent. The amount of boat excise tax paid: Depends on your vessel's class and age—refer to the bmv's excise tax chart for specifics.

7% of the purchase price. All registered boats must have a certificate of title unless they are valued at. Customers operating their watercraft on indiana waterways must also pay an boat excise tax.

Vessels subject to excise tax include motorboats registered in another state and operated on indiana waters for more than 60 consecutive days or moored on the indiana part of lake michigan for more than 180 days. Depends on the vessel’s class and age; Excise tax decals must be affixed on both sides of the boat, be displayed within 3 inches from, and in line with the registration number (only the current decal can be displayed).

Indiana laws in their entirety can be found in the indiana code (ic), indiana administrative code. The bmv neglected to bill 45,201 boat owners for an additional $891,911. Varies according to your boat’s excise class;

And on top of those rates, your municipality or county may tack on another percent or two in local sales tax, too. Varies on boat excise class; Indiana boat registrations expire annually on a staggered basis.

Certain sailboats may qualify for an alternate display location for these decals. 7% of the purchase price. The casual excise tax for a motor purchased alone is 6% with no maximum.

The value is reduced by 10 percent each year up to a 50 percent reduction from the original value. Amount (a) this section applies to a boat which has been acquired, or brought into indiana, or for any other reason becomes subject to registration or the boat excise tax after the regular annual tax payment date in the registration year on or before which the owner is.

Statecodesfilesjustiacom

Indiana Boat Numbers- Indiana Registration Decal Designer - Hoosierdecal

Indiana Boat Registration Ace Boater

Americas Boating Course 3 Edition Rd Indiana State

Sales Taxes In The United States - Wikipedia

Assetskalkomeycom

Displaying The Registration Number And Excise Tax Decals

Do You Have To Pay Taxes If You Live On A Boat Yacht Management

Indiana Boating Laws Regulations Boatsmart Indiana

Indiana Boat Registration Ace Boater

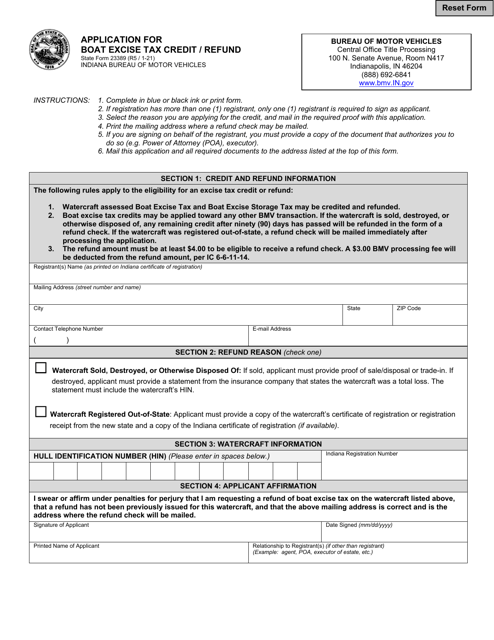

State Form 23389 Download Fillable Pdf Or Fill Online Application For Boat Excise Tax Creditrefund Indiana Templateroller

Dnr State Parks Boating Fees Lake Permits

Indiana Boat Registration Ace Boater

How To Register Motorcycles Boats And More In Indiana

Bmv Registration Plates Watercraft Registration

Dnr Boating Regulations In Indiana

State Form 23389 Download Fillable Pdf Or Fill Online Application For Boat Excise Tax Creditrefund Indiana Templateroller

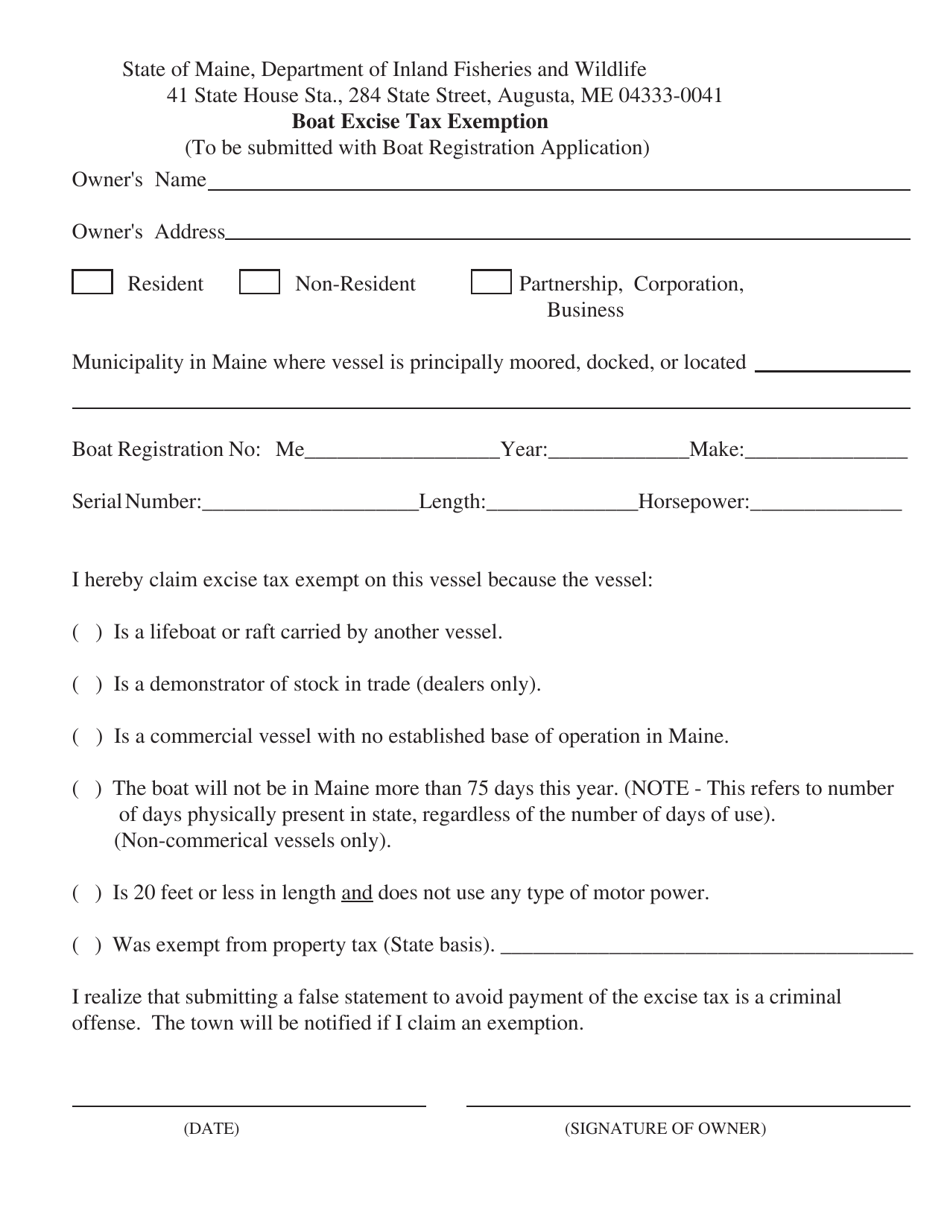

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller

Displaying The Registration Number And Excise Tax Decals