Maryland Digital Advertising Tax Litigation

We discussed her thoughts on maryland's digital advertising tax in an amicus brief she filed with another tax law professor in support of. Ia’s senior vice president and general counsel jon berroya issued the.

Maryland Enacts First-in-the-nation Digital Advertising Tax Pwc

More on the digital advertising tax

Maryland digital advertising tax litigation. She is one of the two tax law professors who. Two tax law professors have submitted a proposed amicus brief in support of maryland in litigation over the state’s new digital advertising tax, arguing that attempts to shield digital advertising from state taxation should be rejected. Today, internet association (ia) joined the u.s.

The maryland digital ad tax case was well underway by the time judge chasanow recused herself tuesday. The initial complaint was filed in february and amended at the end of april. As of this writing, there was legislation pending that would push the effective date of maryland's digital advertising tax to tax years beginning after dec.

If maryland’s digital advertising tax is ultimately enacted, litigation based on federal law principles will quickly ensue. This tax is the first of its kind. We discussed the maryland digital advertising tax lawsuit in federal court, her role in that litigation, and her research on digital services taxes.

Governor larry hogan vetoed the bill, but the legislature will have the opportunity to override his veto in 2021. Maryland’s proposed digital advertising gross revenues tax came closest to taking effect. The tax passed the maryland legislature as part of h.b.

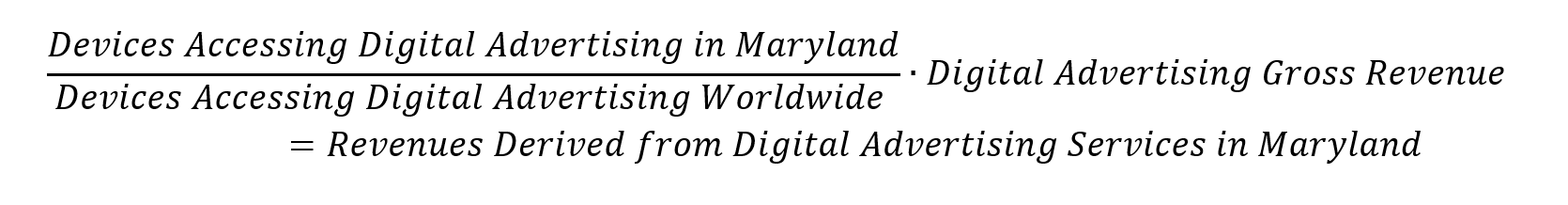

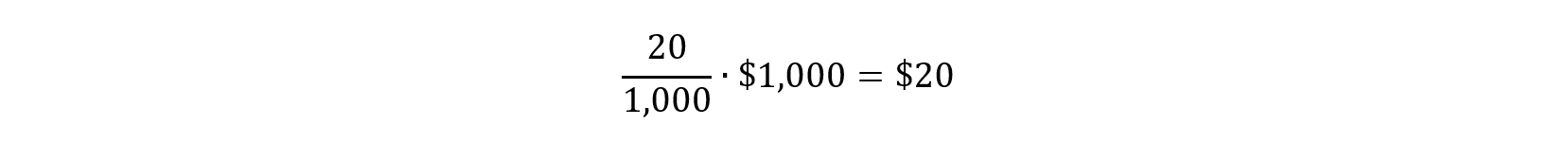

Maryland’s new tax applies to annual gross revenue derived from digital advertising in the state and is imposed at scaled rates between 2.5% and 10% (beginning with taxpayers that have at least $100 million of global annual gross revenue). The act imposes a tax, at rates of up to 10%, on gross revenues “derived from digital advertising services in the state.” the tax could be extremely burdensome, and within days of the act’s enactment, a number of advertising industry groups commenced litigation, in an effort to block implementation of the act. The maryland general assembly enacted two new taxes on digital commerce on february 12, 2021 after the state’s senate overrode the governor’s veto of the legislation.

The law is already facing a major suit from industry groups. Maryland digital advertising gross revenues tax. Digital advertising services tax alert overview on february 12, 2021, the maryland senate, following the house of delegates earlier in the week, voted to override the veto of governor larry hogan to house bill 732, resulting in the enactment of a new gross revenues tax on digital advertising services in maryland.

Taxation of digital advertising services. Maryland recently became the first state to pass a digital advertising services tax, but analysts are waiting to see what courts think of the law before hitting the panic button. The 10% digital advertising gross revenues tax will be imposed on annual gross revenues derived from digital advertising services in maryland.

Further, a return is only required from a person that has annual gross revenue derived from digital. Just days after maryland became the first state in the country to impose a tax on digital advertising targeting big tech, lobbying groups representing companies including amazon, facebook, google. The bill is pending action by the governor (who has 30 days to sign, veto or allow the bill to become law without his action).

The new tax will apply to companies that make more than. Chamber of commerce, netchoice, and computer & communications industry association (ccia) in filing a lawsuit challenging maryland’s digital advertising gross revenues tax (hb 732). Maryland argued that recent u.s.

Statement on md digital ad tax litigation. (cnn business)maryland became the first state in the country on friday to impose a tax on digital advertising, as the state's senate voted to override a. The maryland general assembly on april 12, 2021, passed senate bill 787—legislation that revises two digital services tax laws enacted earlier this year.

States considering similar legislation are likely following the litigation closely. Supreme court precedent in cic services v. Internal revenue service requires the digital advertising charge to be treated as a tax under the tax injunction act.

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Pin On Real Estate Investing

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp - Jdsupra

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp - Jdsupra

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp - Jdsupra

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Maryland Legal Aid Attorney Rashad James Showed Up To Work Prepared To Represent His Client In Expungement Proceedings With Profe Lawyer Judge Business Lawyer

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

A Professional Credit Repair Company Can Help You Get Out Of The Mess By Giving Expert Tips And Advice Benefits Of Using Credit Repair Corporate Law Investing

Find Conveyancer Sydney Conveyancing Ku Ring Gaidrummoynenowra In 2021 School Application Nail Care Business Model Canvas

The 3 Ways Brands Wine Influencers Work Together In 2021 Wine Brands Blogging Inspiration Influencer

10 Switch Regulation Scholar Resume

Maryland Seeks Dismissal Of Case Challenging First-of-a-kind Digital Ad Tax Wtop News

Maryland Passes Digital Advertising Service Tax - Salt Shaker

Maryland Delays Digital Advertising Services Tax Bdo

Resumo Personal Portfolio Template Stylelib In 2021 Personal Portfolio Portfolio Templates Css Website Templates

One Business Plan Four Different Ways Youtube Background Of Entrepreneurs In Sample Maxresde Business Intelligence Law Firm Marketing Writing A Business Plan

Pin On Html Website Templates 2021