Nassau County Tax Grievance Status

To file an appeal and start using assessment review on the web, click on the link below: If you have a property tax grievance and would like to make an appeal, property tax reduction consultants is here to help.

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liheraldcom

Petition to lower property taxes.

Nassau county tax grievance status. March 2.) property tax rates in new york, especially in suffolk and nassau counties, are among the highest in the nation! A plan to phase in nassau county’s reassessment over five years to allow tax hikes to take effect gradually is stalled in the county legislature amid a standoff between majority republicans and. The tax grievance process is a lengthy and complicated one;

We'll perform a property tax assessment and advocate for your interests in your quest to lower your property taxes. Our record reductions in nassau county. March 1 (taxable status date) all property is valued as of its condition on march 1.

Click to request a tax grievance authorization form now. Our consultants serve nassau county, suffolk county, and the rest of long island, ny. Enter user id and password.

Also, march 1 is the deadline for exemption applications for review for the following december property tax bill. Request a case status by completing this simple form, and one of our grievance consultants will get back to you. Nassau county property tax appeal status.

We do the work for you. Long island property tax grievance | heller & consultants tax grievance. File an appeal between january 3,.

We hope that you’ve filed your tax grievance, as nassau county is one of the highest taxed counties in the country. Ar1 ar2 ar3 forms and instructions. In any taxing jurisdiction a property is taxed on the “tax status” date based upon current conditions.

Heller notes that it can take anywhere from 12 to 18 months, from beginning to end, so. Tentative town assessment roll established and made. Fill out and send the application by april 2nd to file a tax grievance in nassau.

Put long island's #1 rated tax reduction company to work for you. If you already have a password, but have forgotten it, please click here. Nassau county property tax grievance nassau county filing deadline extended to april 30 (previous deadline for filing:

These real property assessments can be grieved based upon an overvaluation and/or overassessment. We offer this site as a free self help resource for people like you that want to have their property taxes lowered, but do not want to pay someone else half of your tax savings. If you have not registered, please click here.

In nassau county, the next tax status date is january 1, 2021. You may also look up the status of appeals for past tax years. Nassau tax protest processing deadline:

There’s no home inspection required, if you don’t win a reduction, we don’t charge a fee. There is a new assessment for each year. There is a new assessment for each year.

Property tax grievance is a formal complaint filed against a town’s assessed value on a particular parcel of property based upon comparable sales. The nassau county assessment review commission (arc) has sent final determination letters to property owners who filed grievances on the county’s 2019. After three extensions, nassau county’s 2020/2021 tax grievance filing deadline has finally passed.

Pin On Ny Lifestyle Blog

Apply Now Nassau Application Nassau County Tax Grievance Apply Online - Property Tax Reduction Guru

Heres A Recent Video Done By Vincent J Russo Of The Russo Law Group On Medicaid Planning And Asset Protection Click On The Link To Medicaid Informative Asset

Not Sure How To Get A Property Tax Reduction In Nassau County - Property Tax Grievance Heller Consultants Tax Grievance

Nassau Tax Grievance Firms That Pushed For Changes Donated To Politicians Increased Fees By Millions Newsday

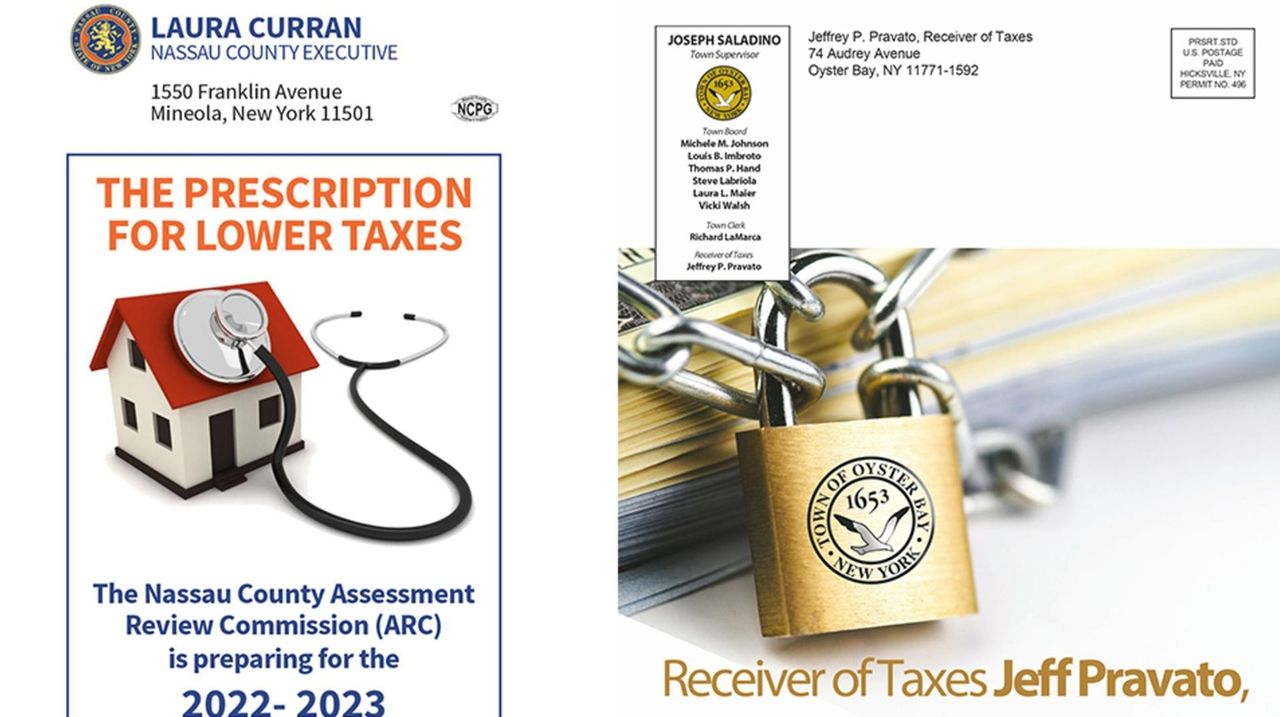

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday

Babylon Ny House Built Building A House Babylon

A Debt Collector Working On Behalf Of A Creditor Can Do Little More Than Demand Payment If The Phrases And Sentences Debt Collection Letters Collection Letter

Nassau County Property Tax Reduction Tax Grievance Long Island

Tax Grievance Deadline 2022 Nassau Ny - Heller Consultants

All The Nassau County Property Tax Exemptions You Should Know About

Maidenbaum Can Help Lower Property Taxes In Nassau County Long Island Appeal Your Property Taxes Click To Request A Tax Gr Nassau County Property Tax Nassau

Pin On Residential

Connetquot River State Park Preserve Suffolk County Ny Suffolk County New York State Parks State Parks

Nassau County Property Tax Reduction Tax Grievance Long Island

1316 Lakeshore Dr Massapequa Park Under Contract - John Cordeira Massapequa Park Ranch Style Home Beautiful Homes

Nassau Residents Protest New York American Waters Tax Grievance Island Long Island American

A Debt Collector Working On Behalf Of A Creditor Can Do Little More Than Demand Payment If The Phrases And Sentences Debt Collection Letters Collection Letter

Make Sure That Nassau Countys Data On Your Property Agrees With Reality