What State Has The Highest Capital Gains Tax

California, with a top rate of 33 percent, has the third highest capital gains tax rate in the industrialized world. California's state level sales tax rate remains the highest in the nation as of 2018 at 7.25%.

Capital Gains Taxes Explained Short-term Capital Gains Vs Long-term Capital Gains - Youtube

The rates do not stop there.

What state has the highest capital gains tax. California taxes capital gains as ordinary income. So, if you're lucky enough to live somewhere with no state income tax, you won't have to worry about capital gains taxes at the state level. California has notoriously high taxes and with up to 39.6% in federal taxes alone, the state taxes can seem especially deep.

States have seven of the top ten capital gains tax rates in the oecd. Venezuela opposition hopes to break stalemate. States with the highest capital gains tax rates.

States with the highest capital gains tax rates. New hampshire and tennessee don't tax income but do tax dividends and interest. California taxes capital gains as ordinary income.

Even taxpayers in states without taxes on capital gains face top rates higher than the oecd average. The highest rate reaches 13.3%. That means there is more than a 50% difference between taking a.

As described below, lane powell has filed a lawsuit seeking to invalidate this tax as unconstitutional on behalf of its clients. Kentucky is ranked 27th in. The 10 states with the highest capital gains tax are as follows:

Hawaii taxes capital gains at a lower rate than ordinary income. 52 rows ak, fl, nv, nh, sd, tn, tx, wa, and wy have no state capital gains tax. Each state has different capital gains tax rates, specifically for the state of kentucky, the latest capital gains tax rate is 5.00%.

The state with the highest top marginal capital gains tax rate is california (33 percent), followed by new york (31.5 percent), oregon (31 percent) and minnesota (30.9 percent). However, taking into account each state’s respective capital gains income, the weighted average rate is 28.9 percent. To answer the question of “how much is capital gains tax in louisville”?

The 10 states with the highest capital gains tax are as follows: Although it is referred to as 'capital gains tax,' it is part of your income tax. Combined with local sales taxes, the rate can reach as high as 10.25% in some california cities, although the average is 8.66% as of 2020.

The highest rate reaches 11%. It is not a separate tax. The highest income tax rates in each state.

Additionally, a section 1250 gain, the portion of a gain on a sale that. Al, ar, de, hi, in, ia,. In the united states of america, individuals and corporations pay u.s.

If you sell stocks, mutual funds or other capital assets that you held for at least one year, any gain from the sale is taxed at either a 0%, 15% or. Breaking this down further, the states with the highest top marginal capital gains tax rates are california (33 percent), new york (31.6 percent), oregon (31.2 percent), and minnesota (30.9 percent). California has the highest capital gains tax rate of 13.30%.

Douglas county superior court judge brian huber last month ruled that a. Capital gains taxes on collectibles. You report capital gains and capital losses in your income tax return and pay tax on your capital gains.

Federal income tax on the net total of all their capital gains. The tax rate depends on both the investor's tax bracket and the amount of time the investment was held. And this is actually a decrease from what it once was—7.5% until proposition 30 expired.

The table below shows the highest tax rates in each state in 2020 that could apply to ordinary income you earn. At the other end of the spectrum, california has the highest capital gains tax rate at a whopping 13.3%. Capital gains tax (cgt) is the tax you pay on profits from selling assets, such as property.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

What Are Capital Gains Taxes For The State Of California

Capital Gains Tax Capital Gain Integrity

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

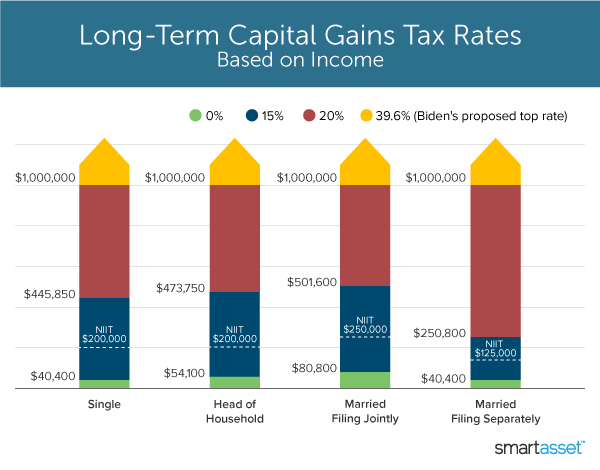

Whats In Bidens Capital Gains Tax Plan - Smartasset

Capital Gains Tax Calculator For Relative Value Investing

Double Taxation Definition Taxedu Tax Foundation

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

How To Pay 0 Capital Gains Taxes With A Six-figure Income

Capital Gains Tax Calculator For Relative Value Investing

Understanding The Tax Implications Of Stock Trading Ally

How To Calculate Capital Gains Tax Hr Block

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Capital Gains Definition 2021 Tax Rates And Examples

The Average Household Income In America - Financial Samurai

Capital Gains Tax 101

Whats Your Tax Rate For Crypto Capital Gains

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State